Despite the economy stabilising in August, the recovery in China falls short of expectations. Southeast Asian economies are likely to suffer in particular from the collapse in demand from China. Slowing inflation dynamics should allow for further monetary easing.

Number in focus

The Manufacturing Purchasing Managers’ Index for emerging markets stood at 51.4 in August. This is significantly above the figure for many developed nations, which have experienced a slump in sentiment over recent months. In August, for example, the Purchasing Managers’ Index for the industrial sector stood at 43.5 in the eurozone and 47.9 in the US, both of which are well below the growth threshold of 50.0. In recent months, the index for the emerging markets has remained robustly above 50.0 and hints at some divergence between emerging and developed markets, despite the surprisingly short-lived rebound in China following the reopening of its economy.

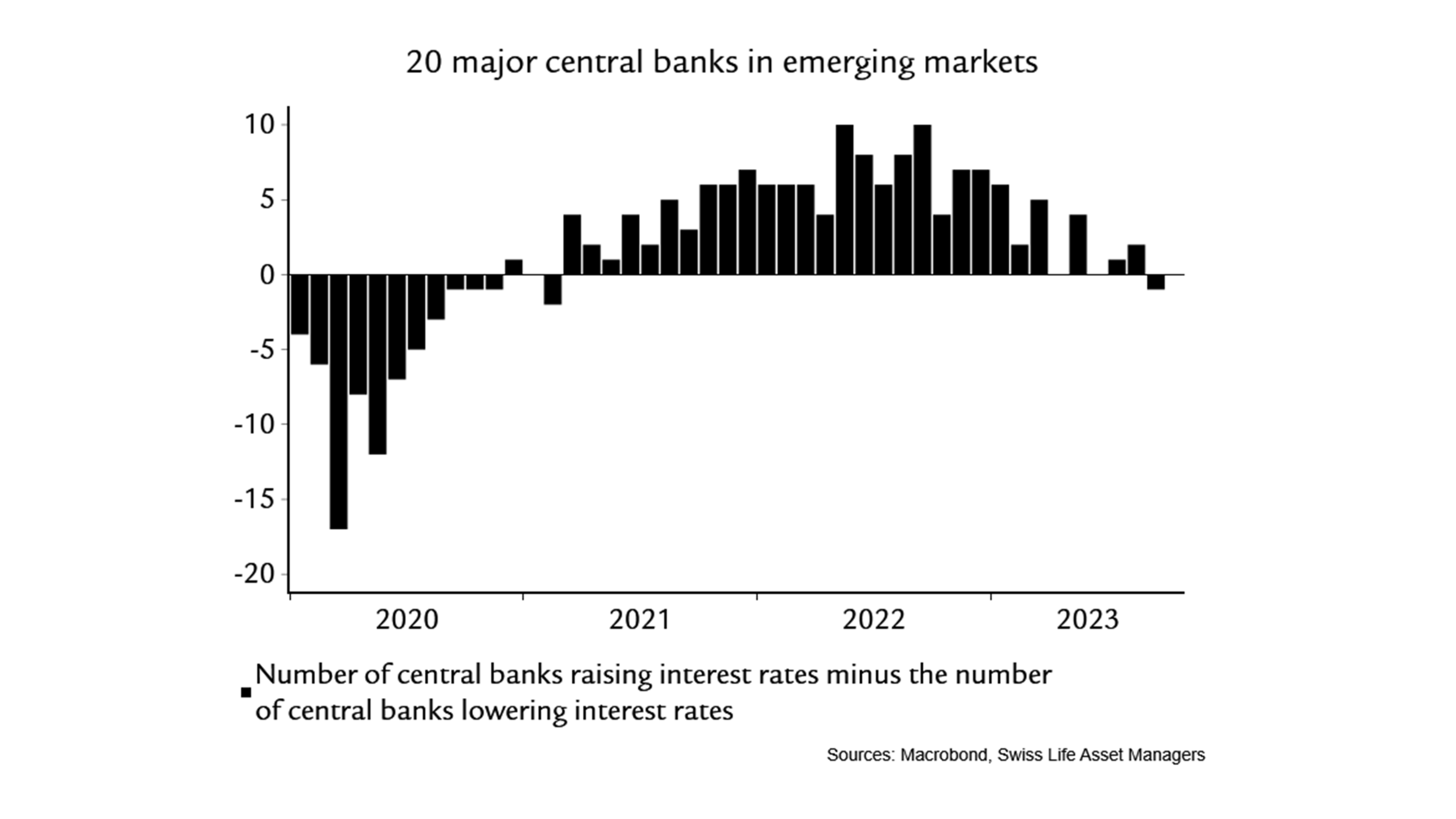

Chart in focus

While central banks in developed markets are only slowly reaching the end of their cycle of interest rate hikes, the major central banks in emerging markets are already one step ahead. The central banks in Brazil and Chile, for example, have already started to lower key interest rates again due to the favourable inflation trend. Thanks to the early and consistent tightening of monetary policy, emerging markets have succeeded in somewhat reducing their dependency on the monetary policy implemented by the US Federal Reserve and are already lowering interest rates ahead of the Fed, without local currencies incurring significant losses.