Recovery of domestic demand in emerging markets, while China fails as a growth engine. As soon as the US Federal Reserve cuts interest rates, the cycle of rate cuts in the emerging markets will widen. Geopolitical risks remain elevated and are one of the biggest risks to our outlook.

Number in focus

According to a Bloomberg survey, GDP growth of 4% is expected for the emerging markets in 2024, compared to expected growth of 3.9% for 2023. As external demand is expected to be rather sluggish, domestic demand will be the driving force behind emerging market growth. We particularly expect inflation to fall further, supporting private consumption and allowing for a broader cycle of interest rate cuts, which should boost investment.

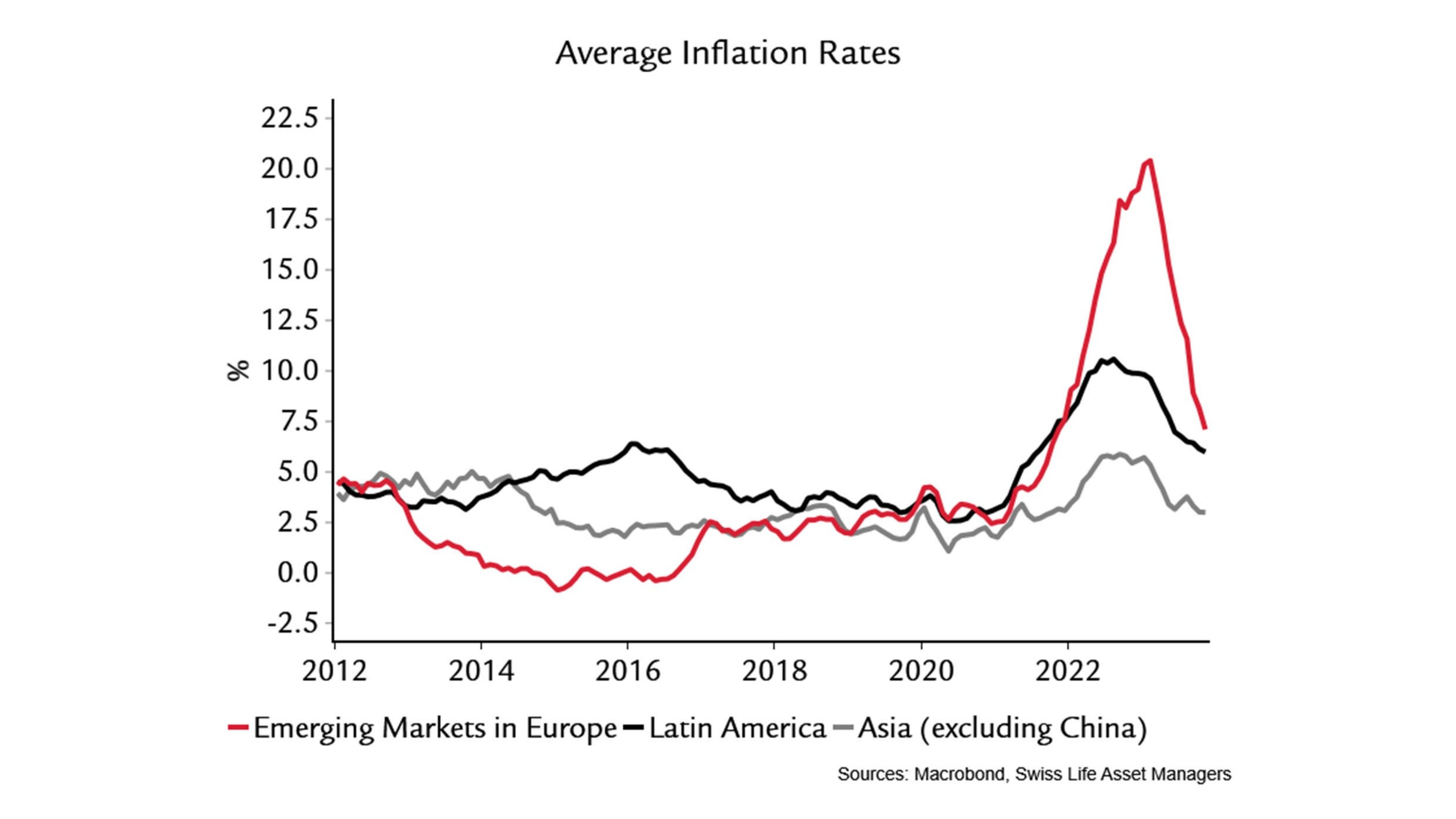

Chart in focus

The downward trend in inflation rates is likely to continue in most emerging markets in the course of 2024, bringing inflation rates into the central banks’ comfort zone. Accordingly, we expect the rate-cutting cycle to be extended beyond the first countries that have already started to reduce their rates, especially once the US central bank cuts its own interest rates. The fall in inflation will be most pronounced for goods, while services inflation will remain somewhat more stubborn.