Eurozone: Slight recovery due to the interest rate turnaround and the recovery of purchasing power. USA: The cooling labour market and dwindling excess savings are weighing on consumption. China: No growth impetus for the global economy due to weakness in the real estate sector.

Chart of the year

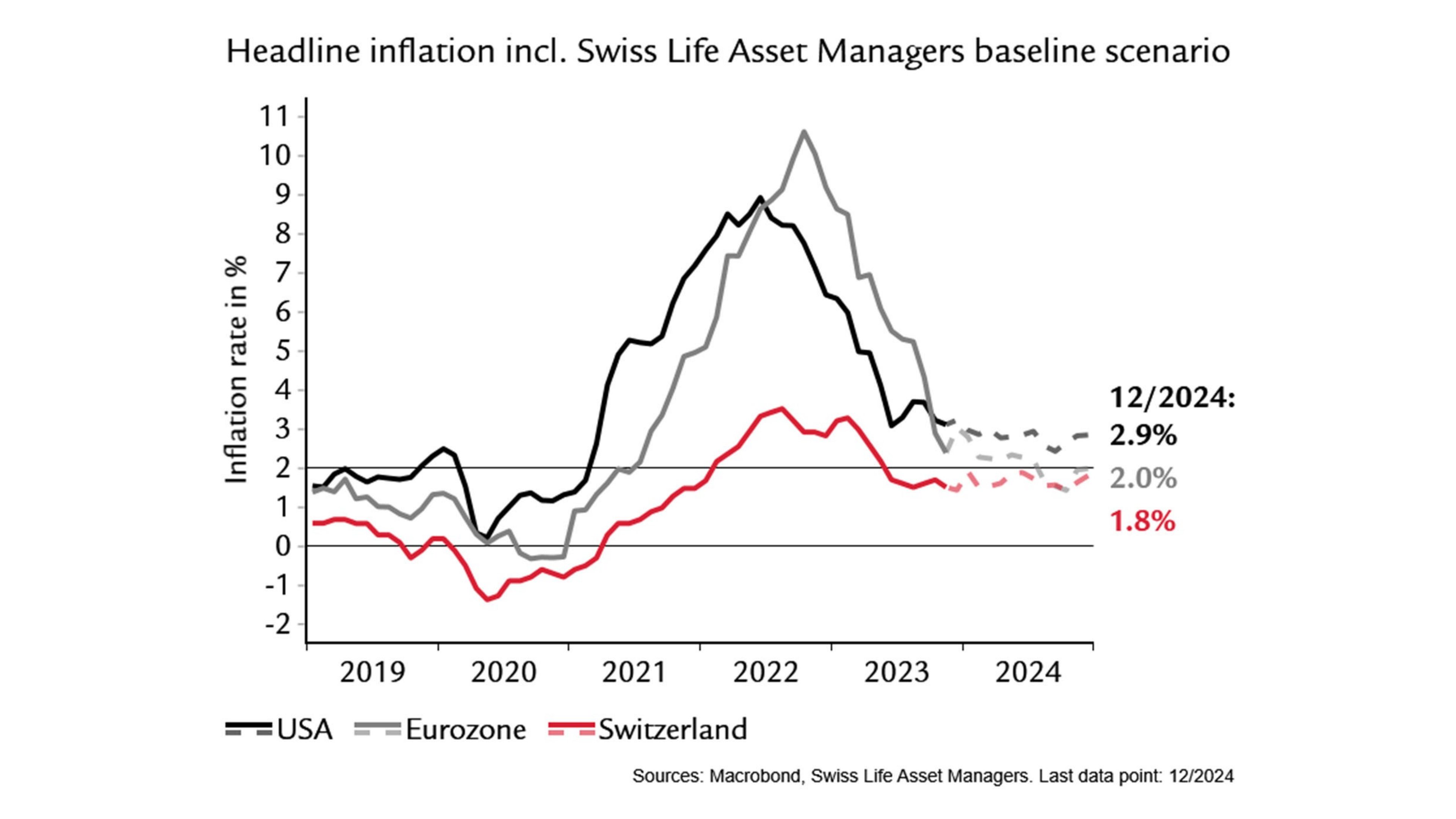

Disruptions in supply chains and high energy prices have shaped the inflation trend over the past two years, but finally came to an end in 2023. The double digit inflation rates seen in Europe at times are likely to go down in history as an anomaly. The inflation trend is now primarily demand-driven again, and the central banks’ focus is thus on wage growth and service price inflation, both of which are cyclical. The weak economy should therefore ensure that inflation is around 2% in the eurozone and Switzerland at the end of 2024 – within the central banks’ “comfort zone”. We see inflation risks in the US as somewhat higher.