USA: Early warning indicators continue to point to an economic slowdown. Eurozone: Despite falling inflation, it is still too early for the ECB to give the all clear. China: After weak growth in the second quarter, the hoped-for stimulus package has failed to materialise.

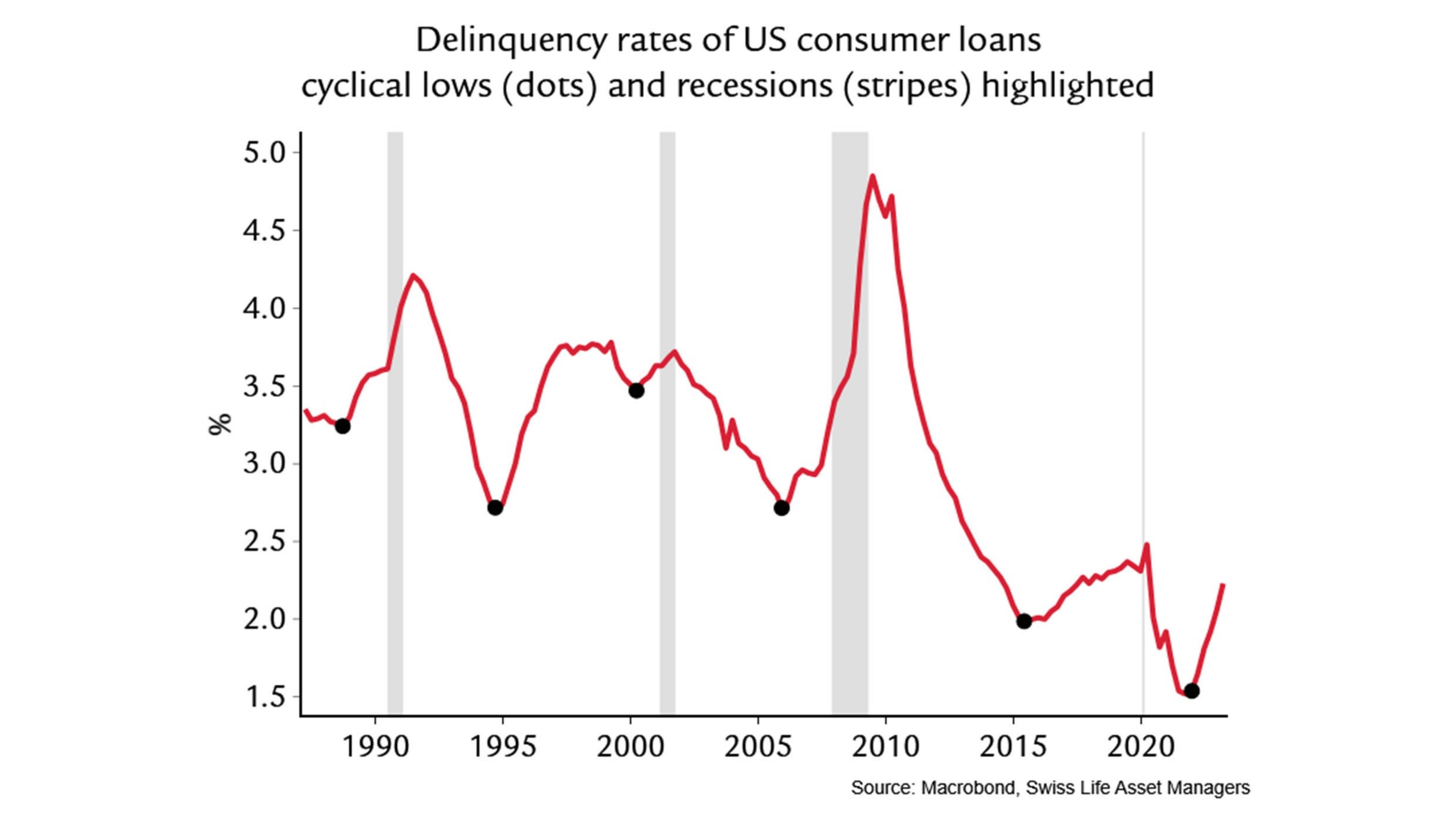

Chart of the month

A recession will only begin in the US when private consumption, which has been robust to date, cools. While leading indicators from industry and the housing market have been on red for some time, the problem with consumption is that many indicators do not turn until the recession has already begun. Probably the best leading indicator is consumer credit delinquencies, which have in the past spiked up one to two years before the onset of a recession. Since October 2021, credit delinquencies have been increasing from low levels. We therefore expect higher interest rates and tighter credit standards to increasingly act as a drag on consumption as well.