Eurozone 2023: weak recovery after mild winter recession; inflation falling, but not below 2%. USA 2023: mild recession from second quarter, slight increase in unemployment, falling inflation. China 2023: earlier than expected cyclical upturn due to departure from zero-Covid policy.

Chart of the year

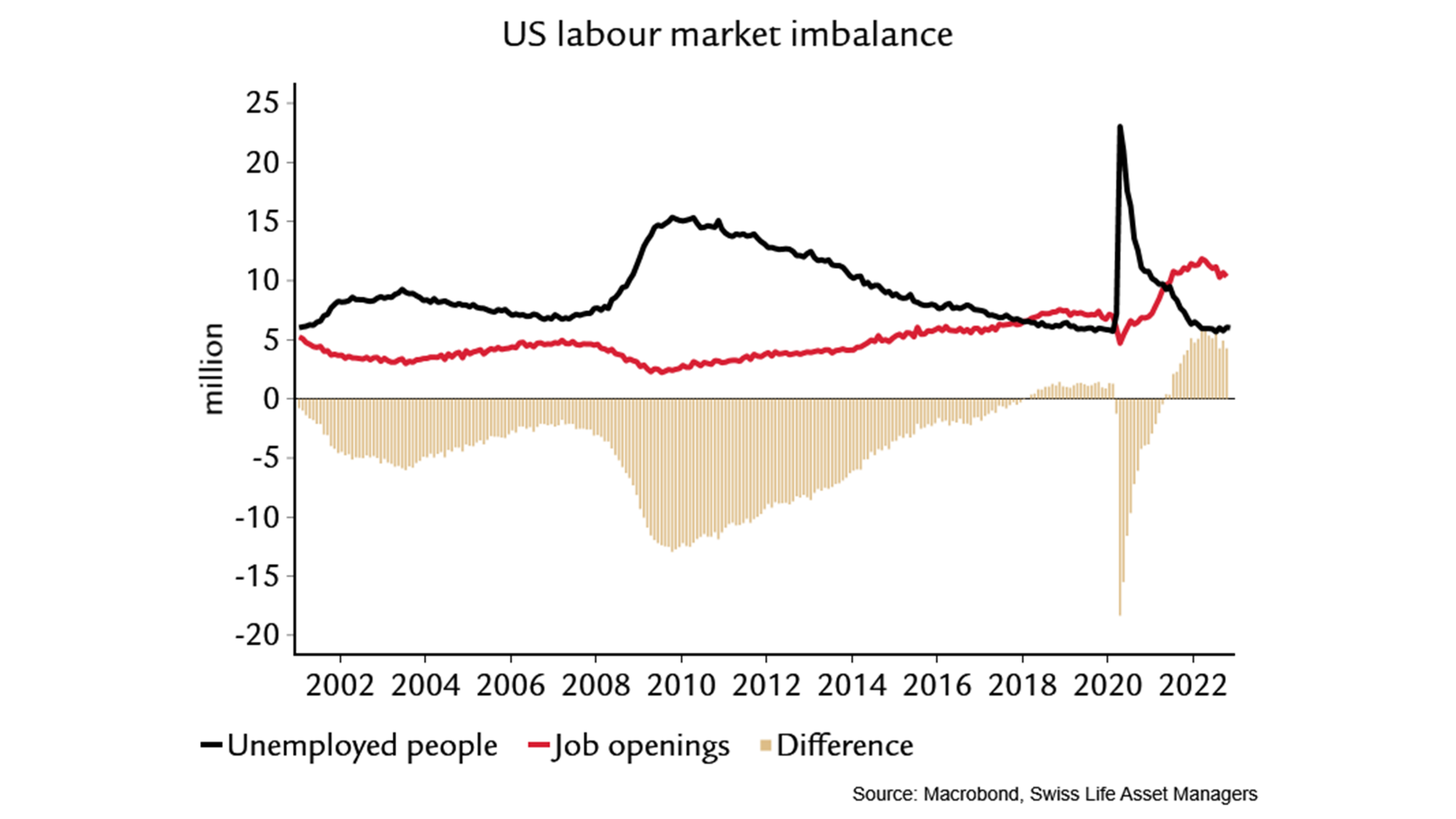

The decisive factor for the economic and financial market outlook for 2023 will be how long and to what extent the Federal Reserve still has to hike interest rates and whether there is already scope for interest rate cuts at the end of 2023. This, in turn, depends on the US labour market, which continues to deliver solid figures and where the gap between job vacancies and the unemployed is causing wage pressure. However, the labour market is lagging behind the already cooling economy. We therefore expect a slight rise in unemployment and easing wage pressure, especially in the second half of the year, in the wake of a US recession – even if it is only mild.