Recession fears continue to rise following weak consumer and corporate survey data. As interest rates rise, concerns about European sovereign debt are increasing and provoking ECB activism. Inflation risks remain on the upside, the situation with regard to Russian gas supplies is worsening.

Chart of the month

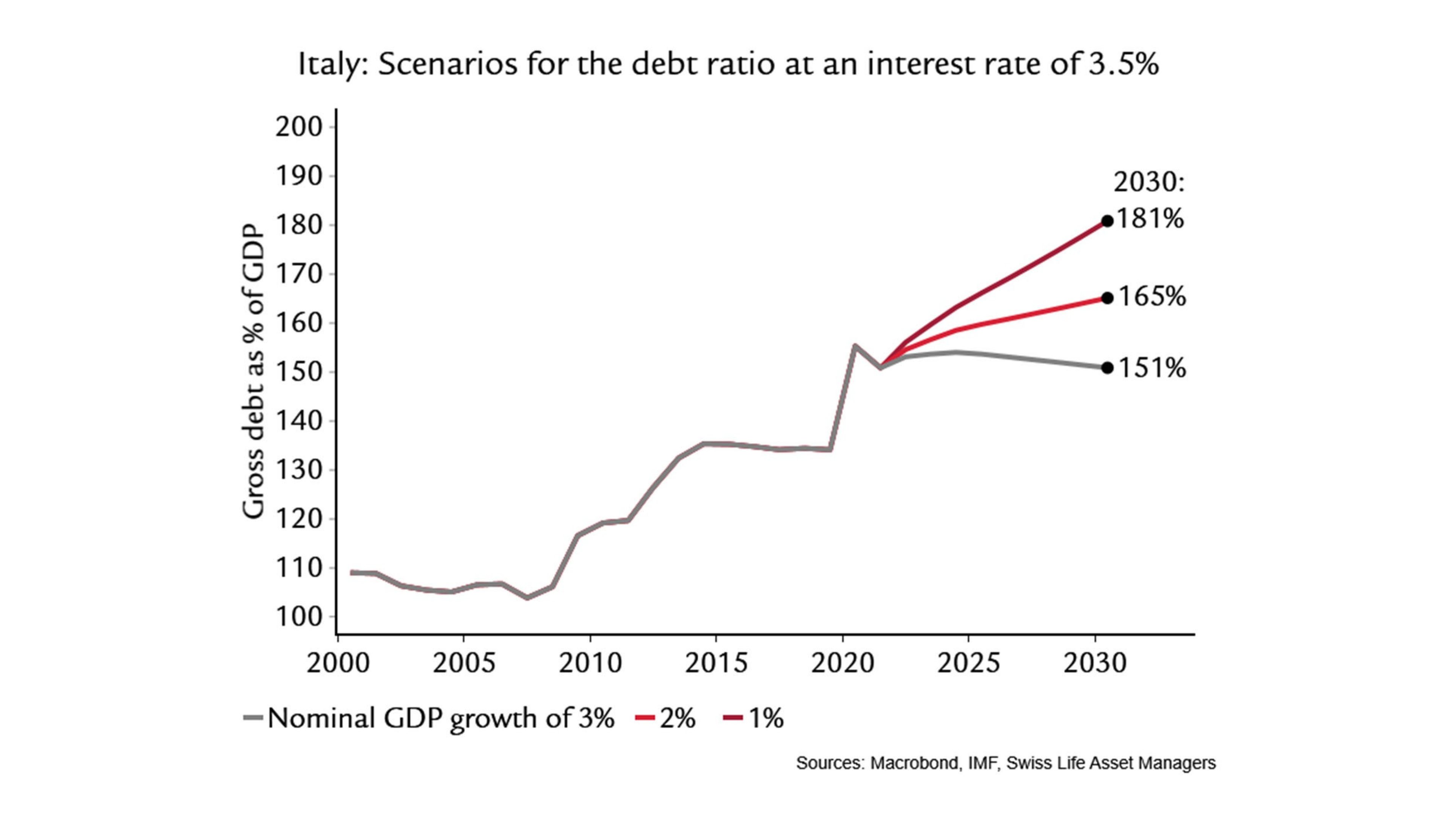

The interest rate turnaround is here, and thus the question of whether a new debt crisis is looming in the Eurozone. The yield differential (“spread”) between Italian and German government bonds has widened, triggering activism by the European Central Bank, which aims to counter the “fragmentation” in the Eurozone. Whether Italy’s debt situation is sustainable at the current interest rate of 3.5% on 10-year bonds depends on nominal growth. Assuming Italy’s budget returns to a primary surplus within five years, Italy would need to achieve real growth of 1% and inflation of 2% (= nominal growth of 3%) to stabilise the debt ratio.