The war in Ukraine and the sanctions are hitting the Eurozone much harder economically than the USA. We anticipate a poorer growth/inflation mix in 2022, with stagflation as a risk scenario. Supply bottlenecks are partially exacerbated again, while lockdown measures in China pose an additional risk.

Chart of the month

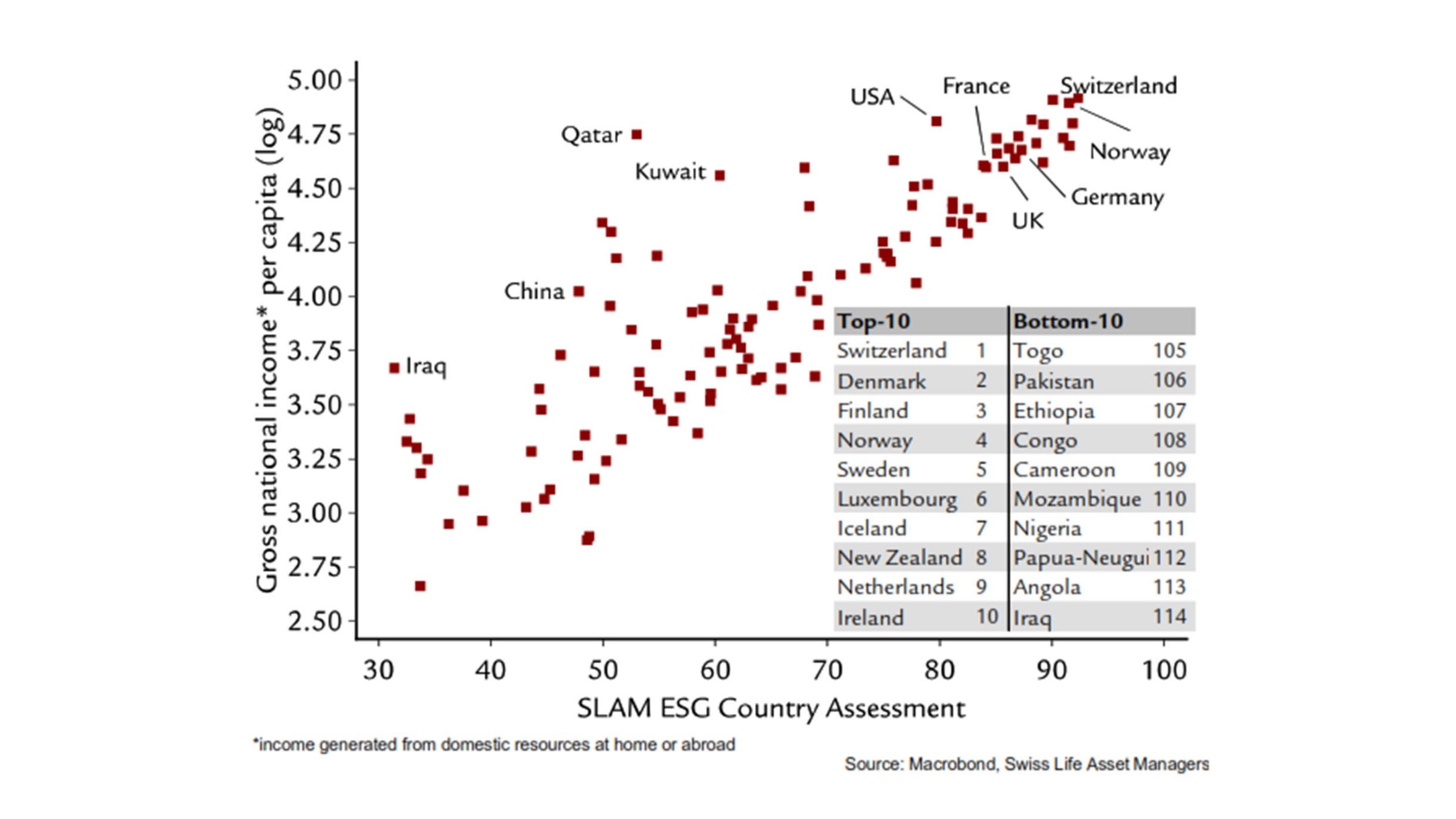

The latest update of our in-house ESG assessment (environmental, social and governance) for 114 countries puts Switzerland in first place, followed by Denmark. Iraq and Angola come last. The ESG rating is strongly correlated with conventional economic measurements such as gross national income (GNI)* per capita. What stands out here, however, is that well-known oil states in particular, as well as China, Turkey and the USA have a relatively low ESG rating in relation to their GNI. Compared with other developed countries, the USA performs particularly poorly in terms of social issues, such as minority discrimination and access to education and health.