Coronavirus: v-shaped recovery in China from current standstill remains our base case assumption. Spill-overs from China and the current outbreak in Europe will weigh on growth in Eurozone and Switzerland. In the short-term, lower energy prices result in lower headline inflation numbers in the US and Switzerland.

Chart of the month

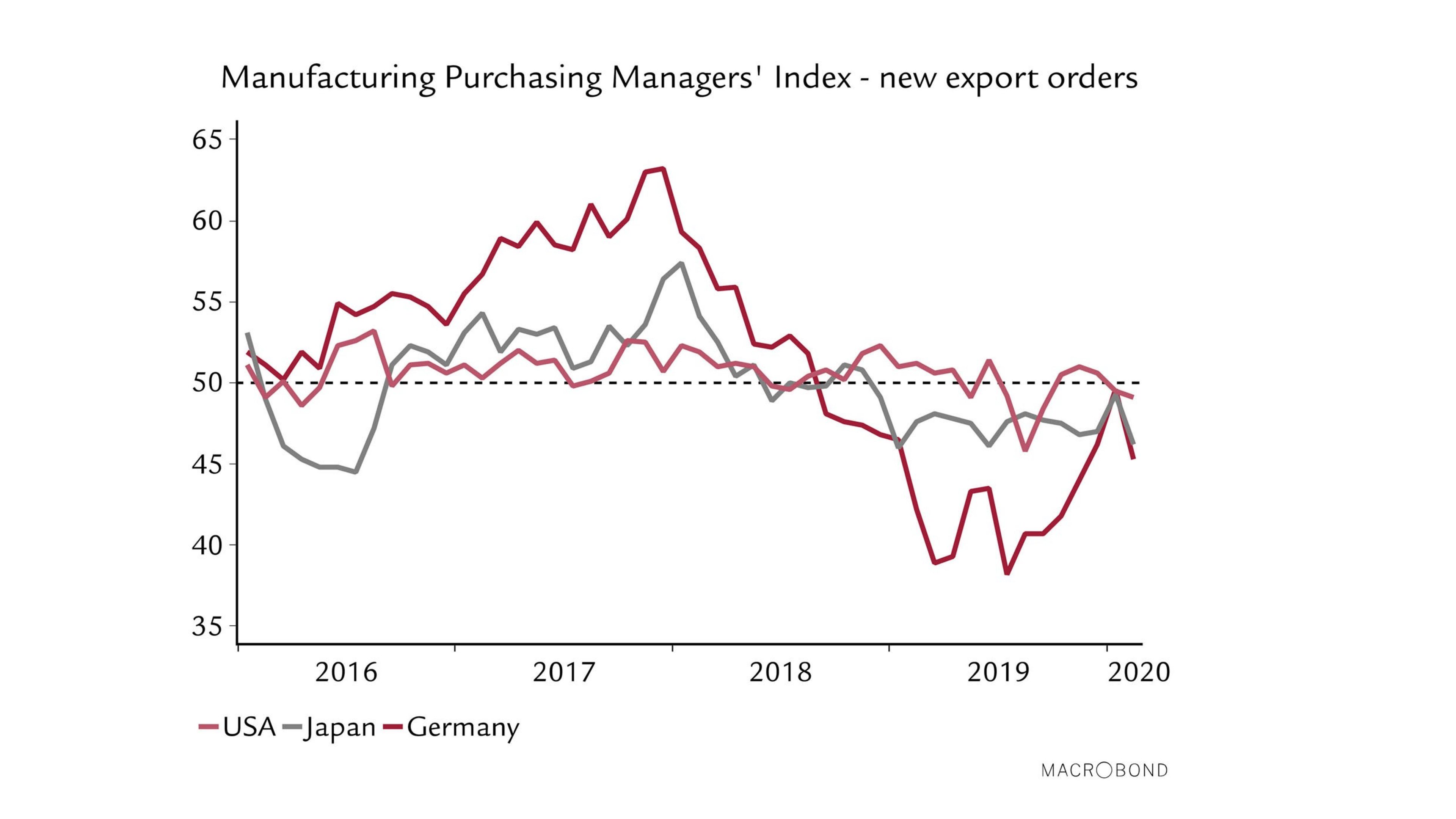

There is no doubt that the coronavirus outbreak will hit China’s economy sharply in the first quarter 2020. We expect spill-over effects on the global economy through exports, global supply chains and tourism, particularly for Asian economies with close ties to China. Some pessimism associated with the coronavirus outbreak is already visible in the new export order sub-component of the February Purchasing Managers’ Index. A decline was reported in Germany, Japan and the US. We expect a further deterioration after the recent spreading in Europe.