In our base case, the world economy recovers in the second half 2020 in a U-shaped form from recession. China: coal consumption, which can be used as a proxy for industrial activity, rises continuously. Coronabonds? The Eurozone will likely need to resort to some form of risk sharing

Chart of the month

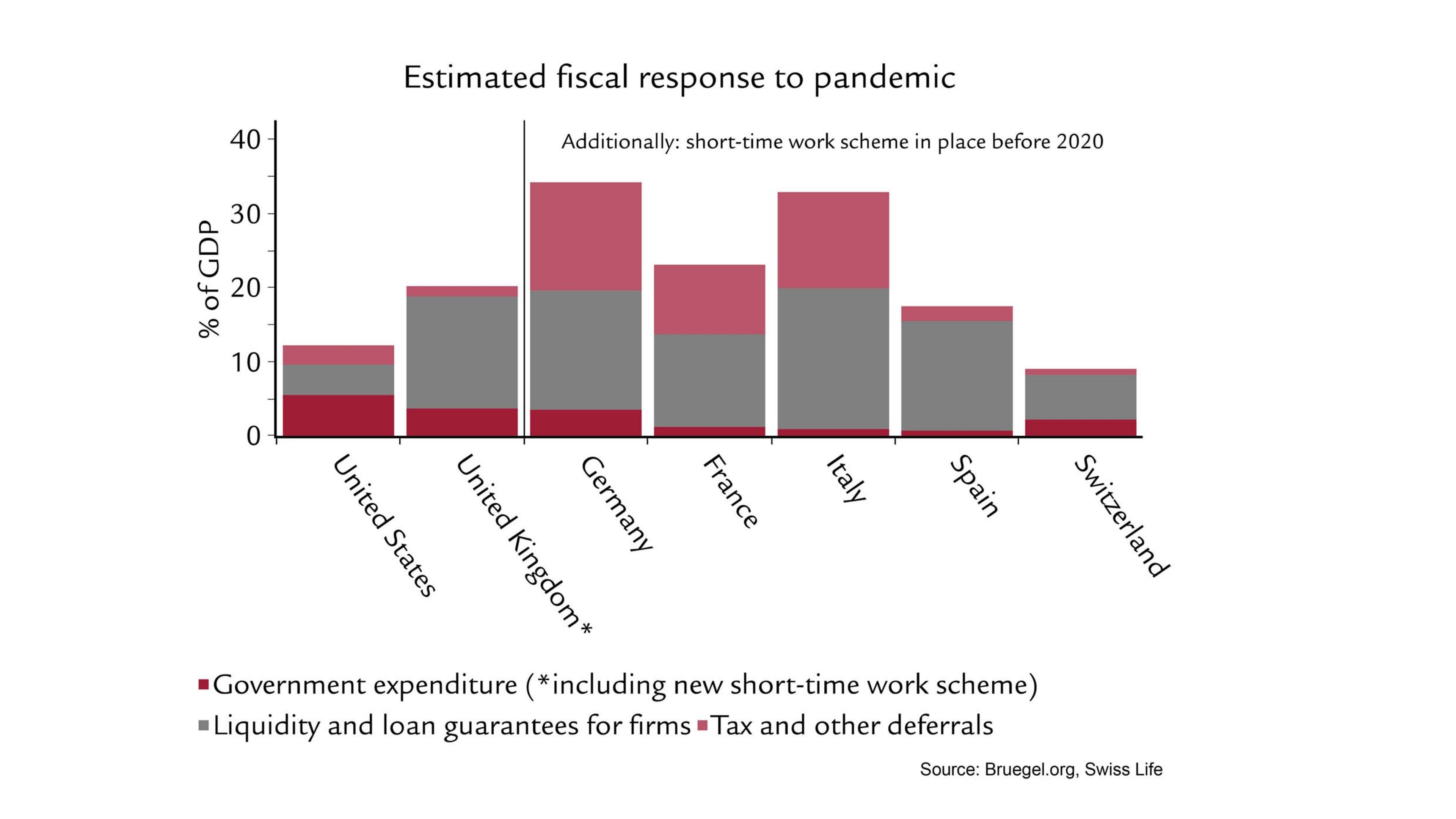

With the global spread of the coronavirus and the implementation of strict containment measures, most economies will experience an enormous drop in economic output. Fiscal and monetary authorities have already announced generous stimulus measures, which include new discretionary spending (dark red bars) as well as liquidity provisions and loan guarantees for companies (grey bars). Besides these measures, shorttime work schemes already in place before 2020 are key to cushion the impact on labour markets. The UK introduced such a scheme in March 2020. With no such scheme in place, the US will likely experience a sharp increase in unemployment despite its $2 trillion spending package.