The consensus view is that monetary policy has peaked, as inflation rates across Europe retreat closer towards central bank targets. This will provide well-needed stability across financial markets and thus clarity on asset pricing – an opportunity investors should be ready to take.

Only those investors who actively manage their portfolios and the assets they contain will continue to generate sustained value creation in the future. The current situation on the property markets is by no means an impossible task for investors, but it must be tackled with a great deal of expertise, resources and motivation.

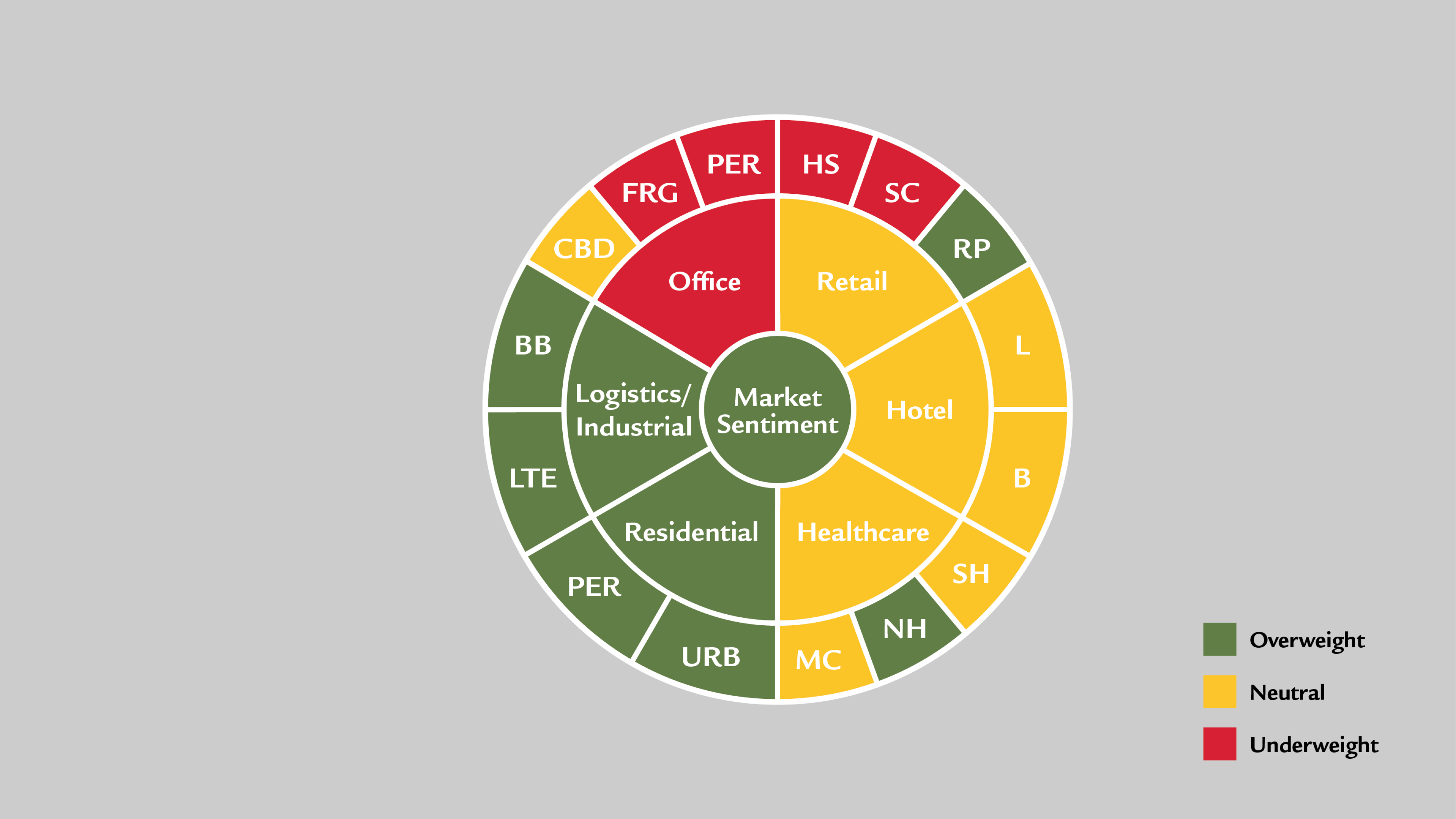

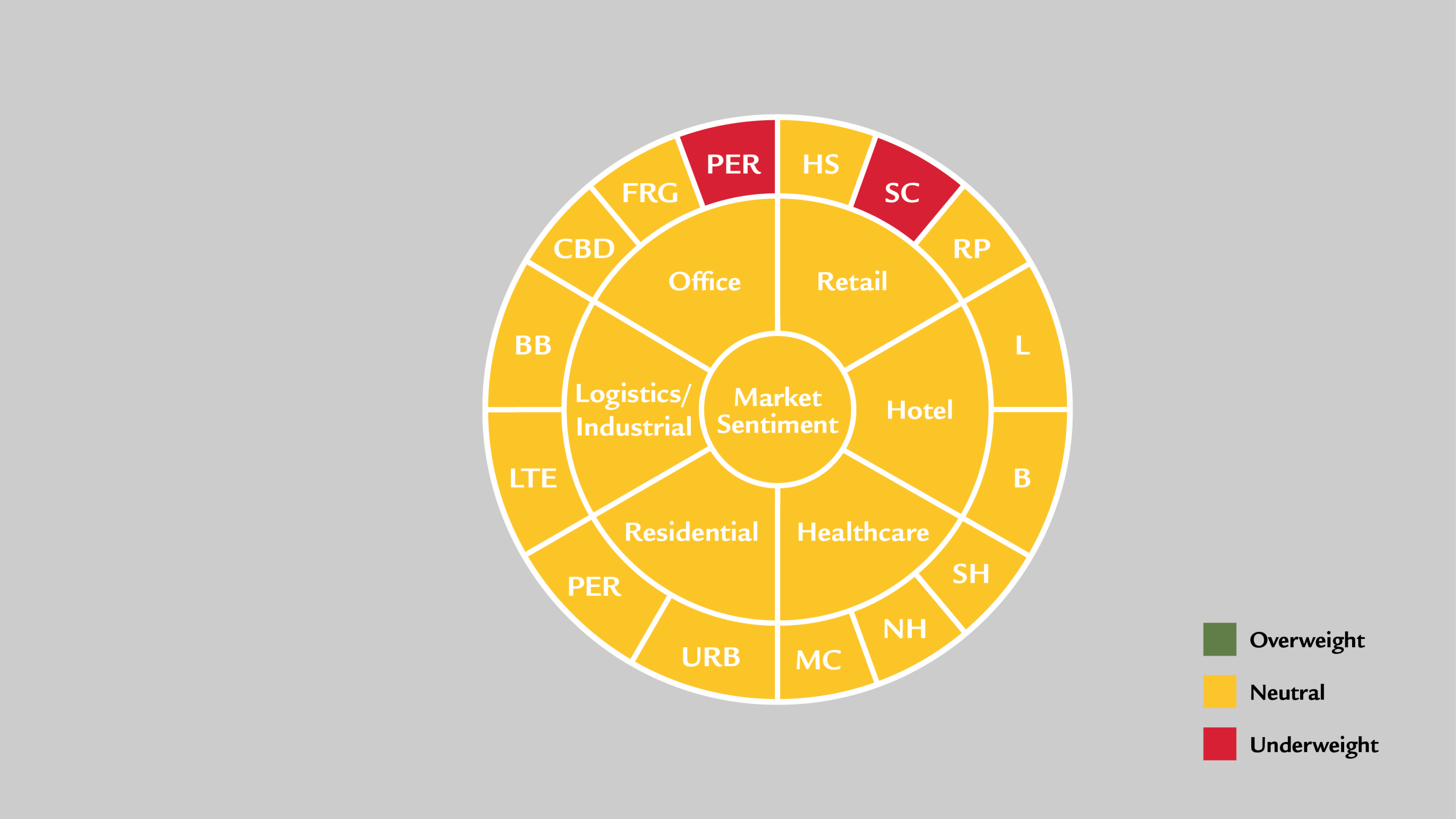

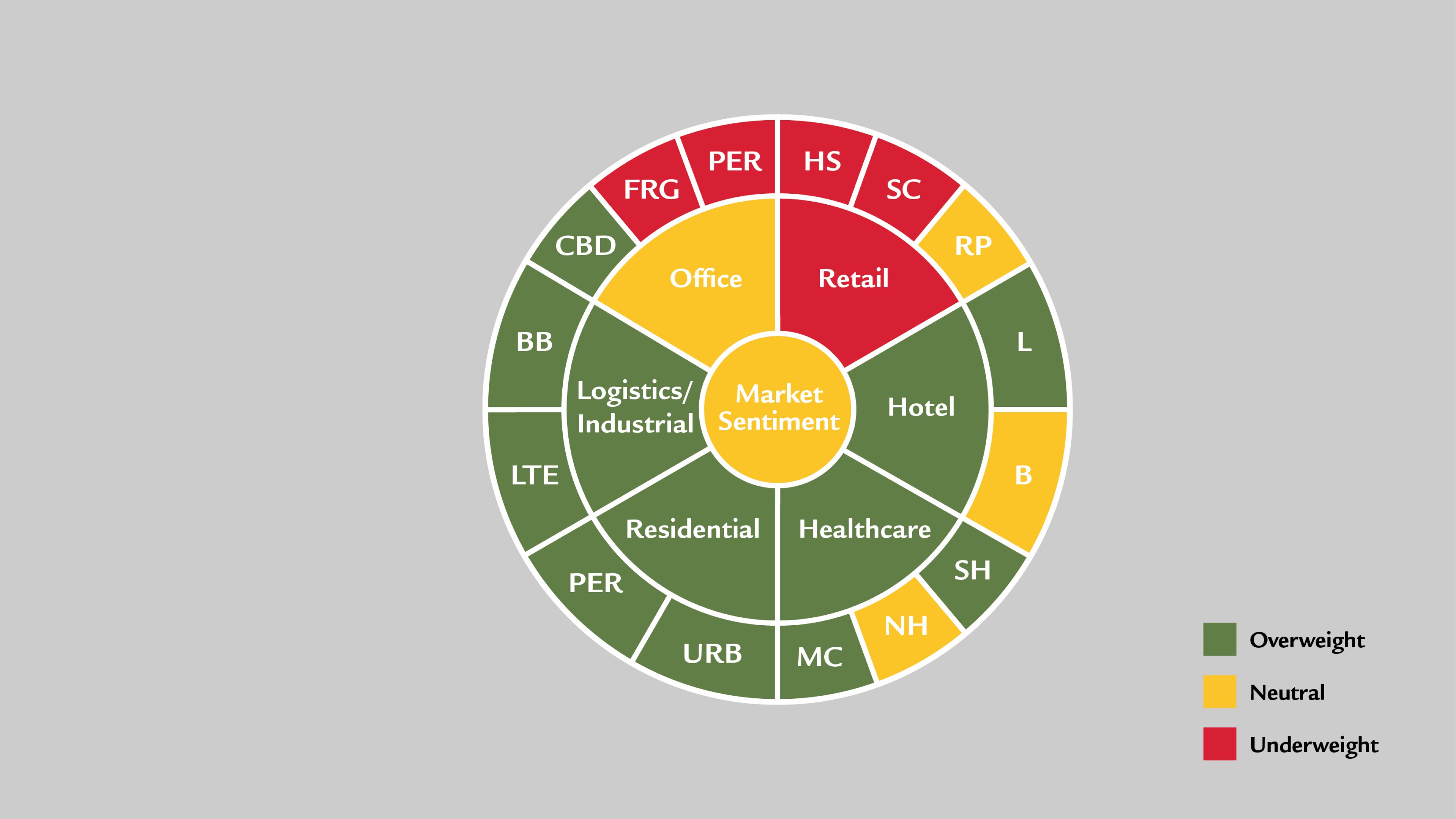

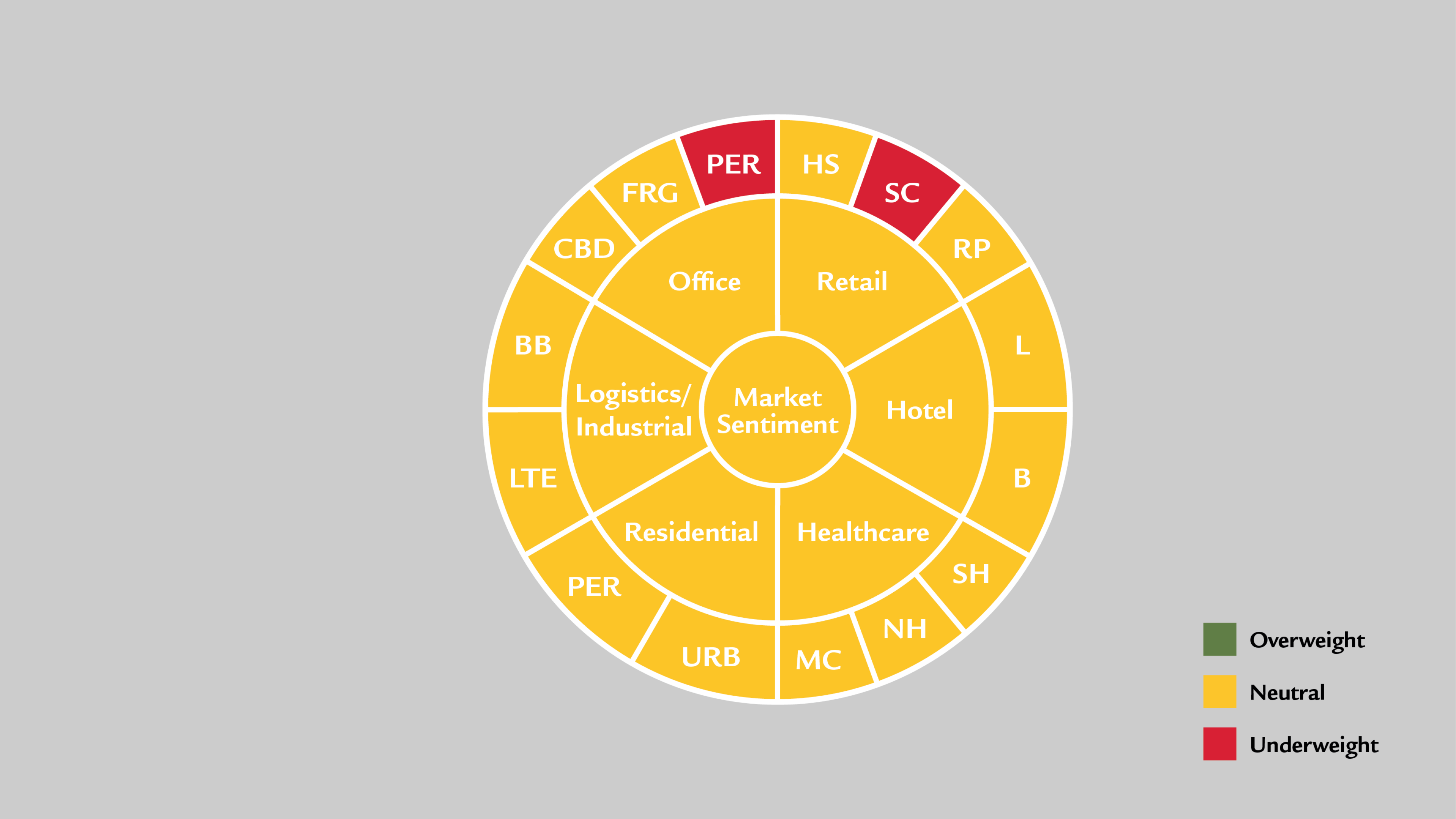

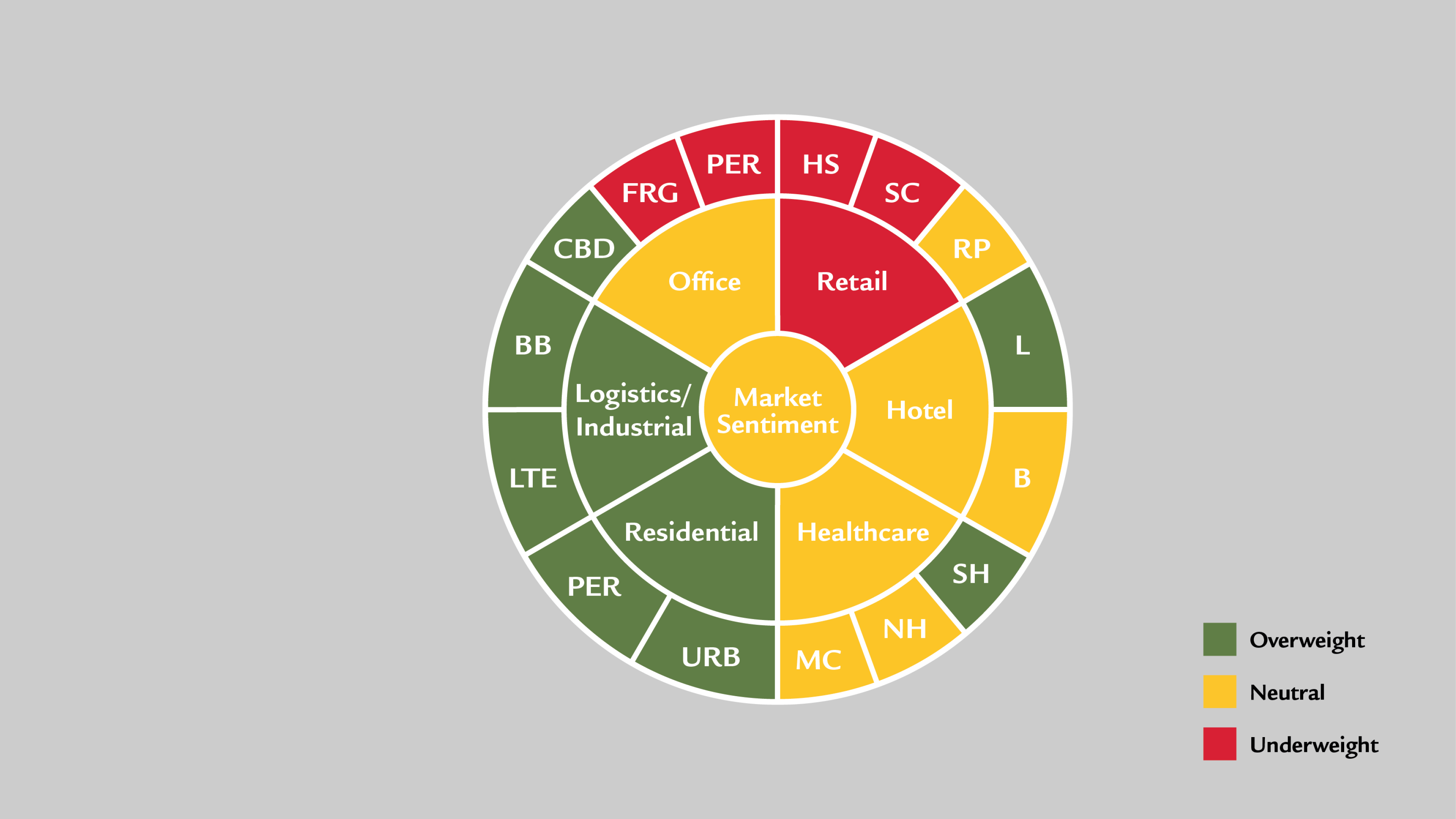

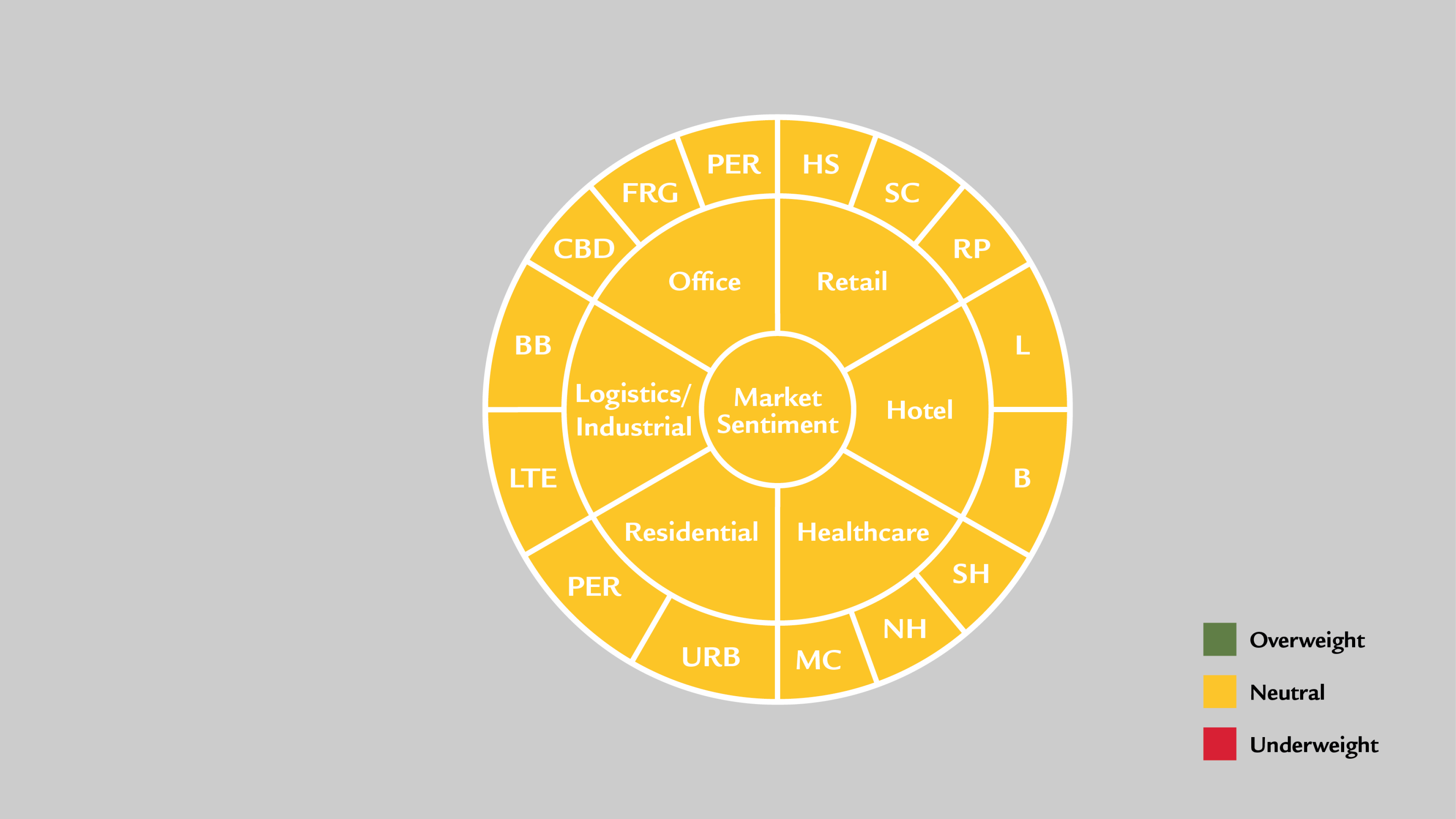

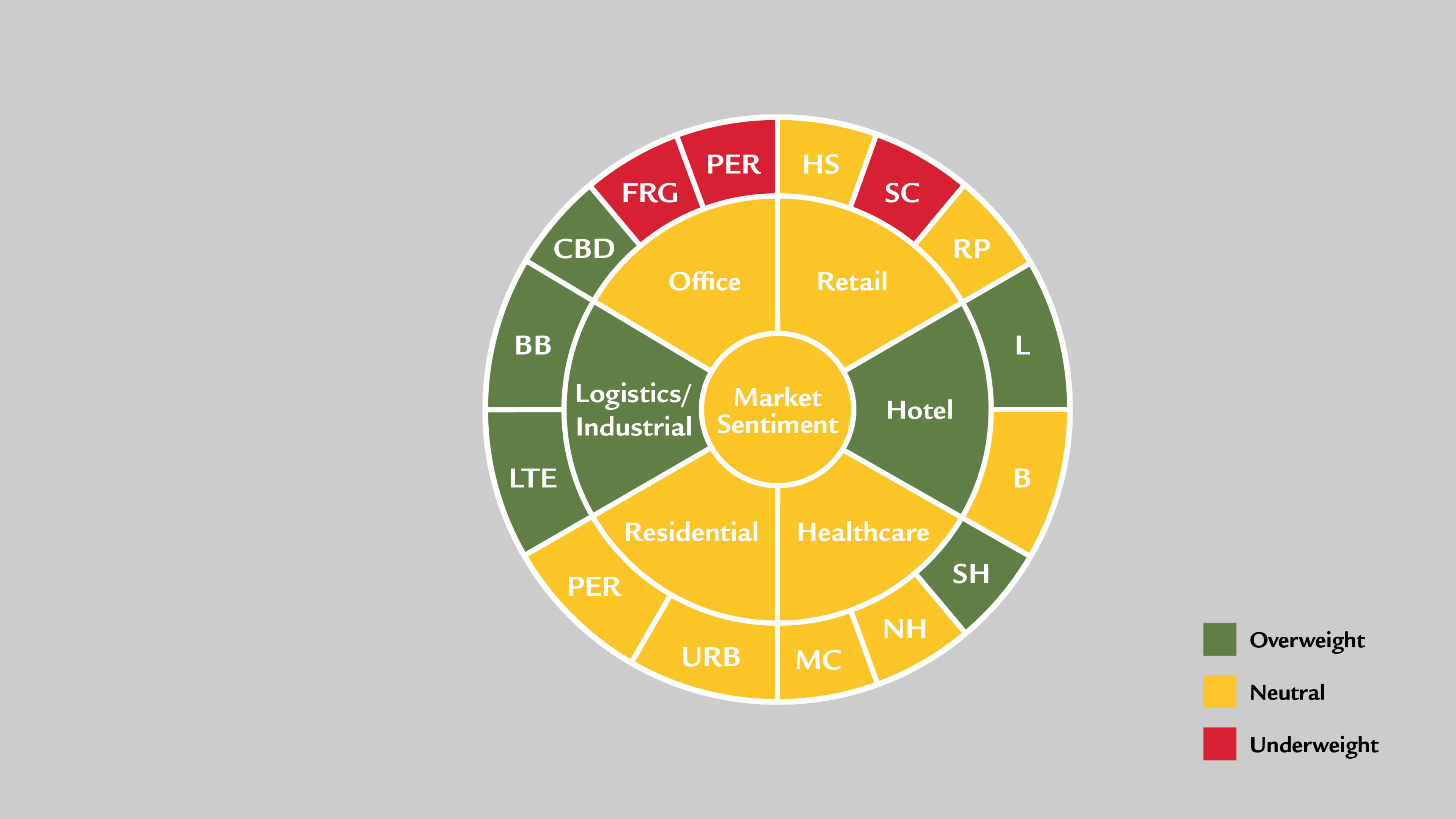

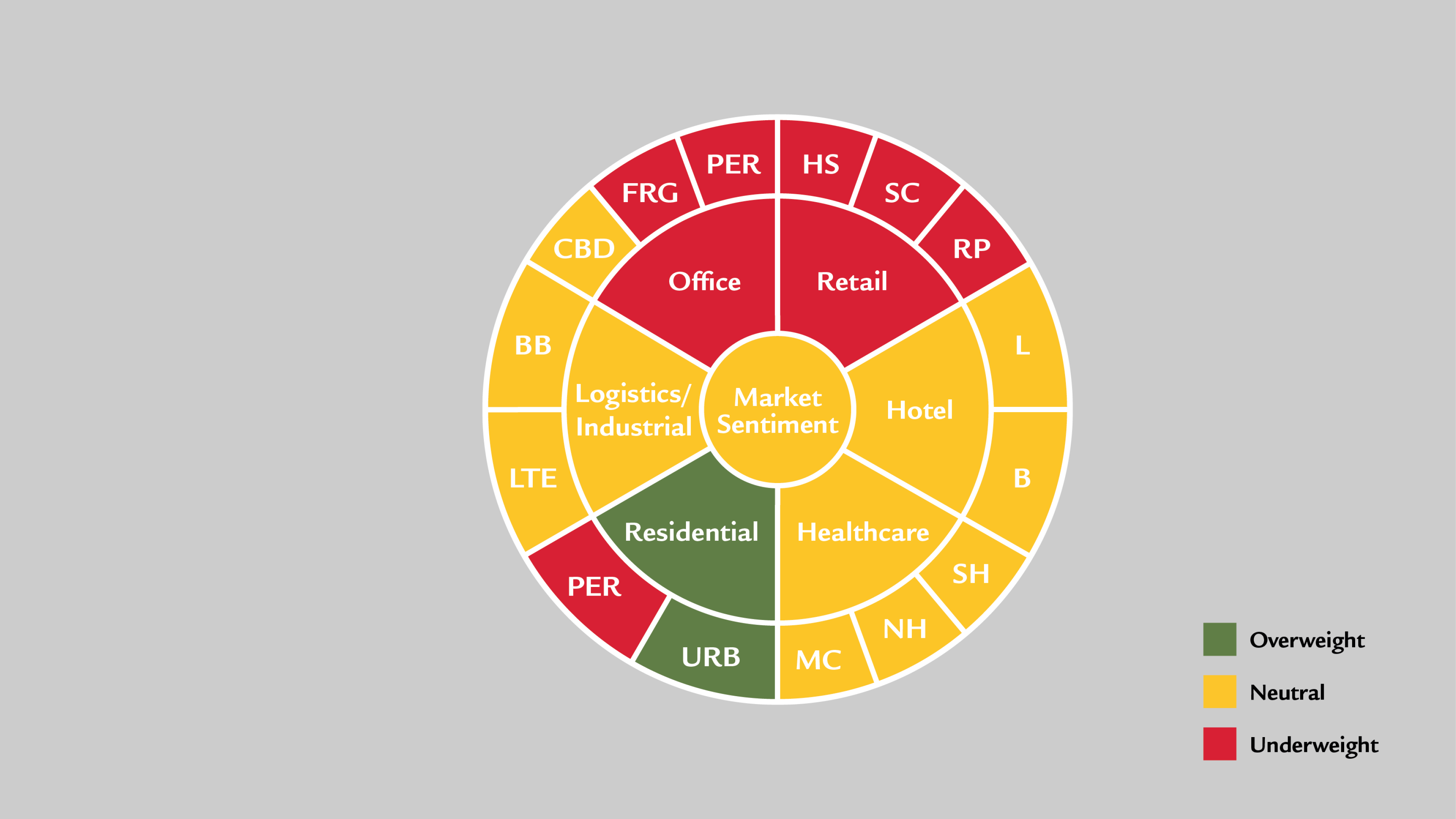

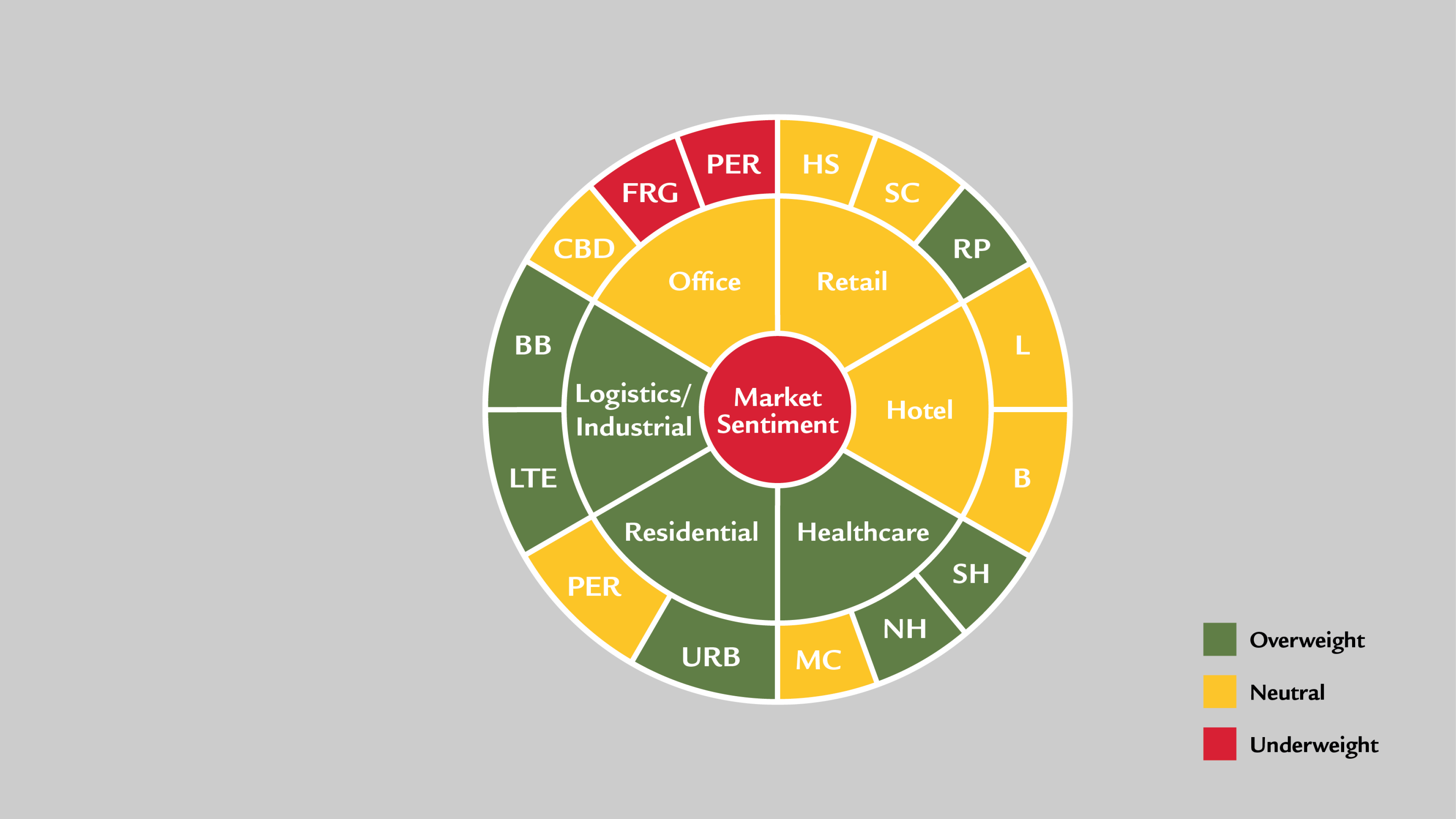

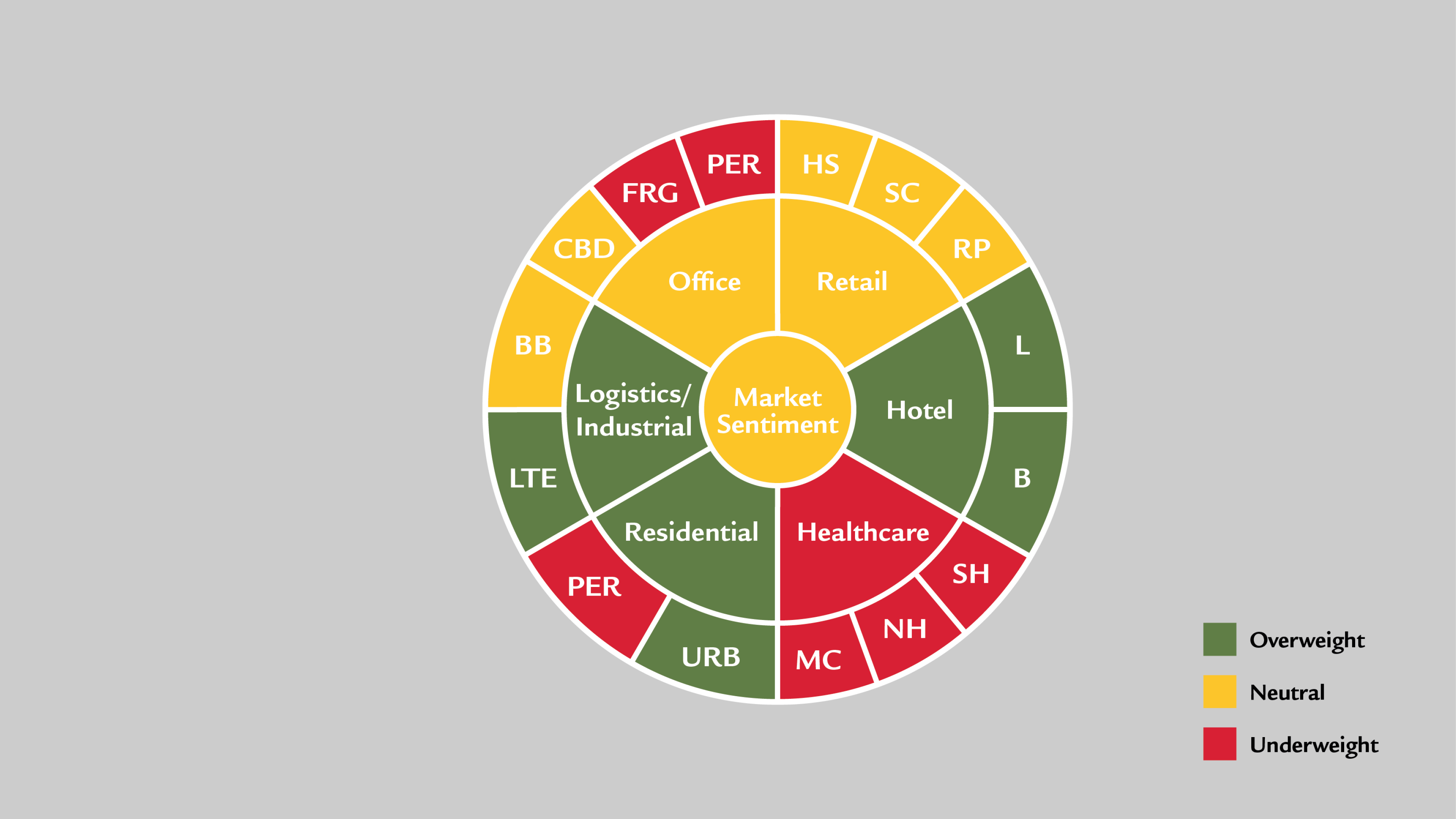

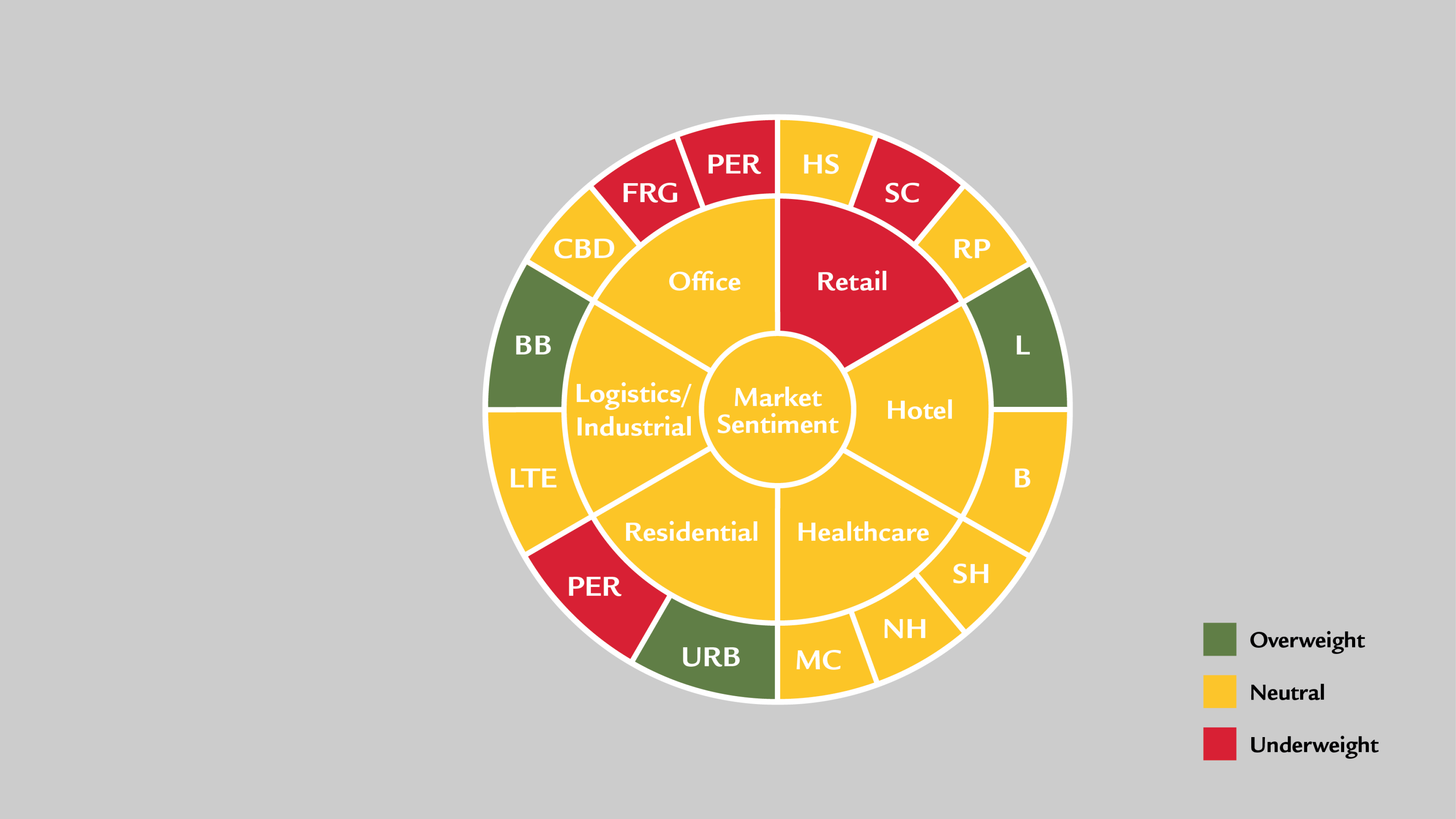

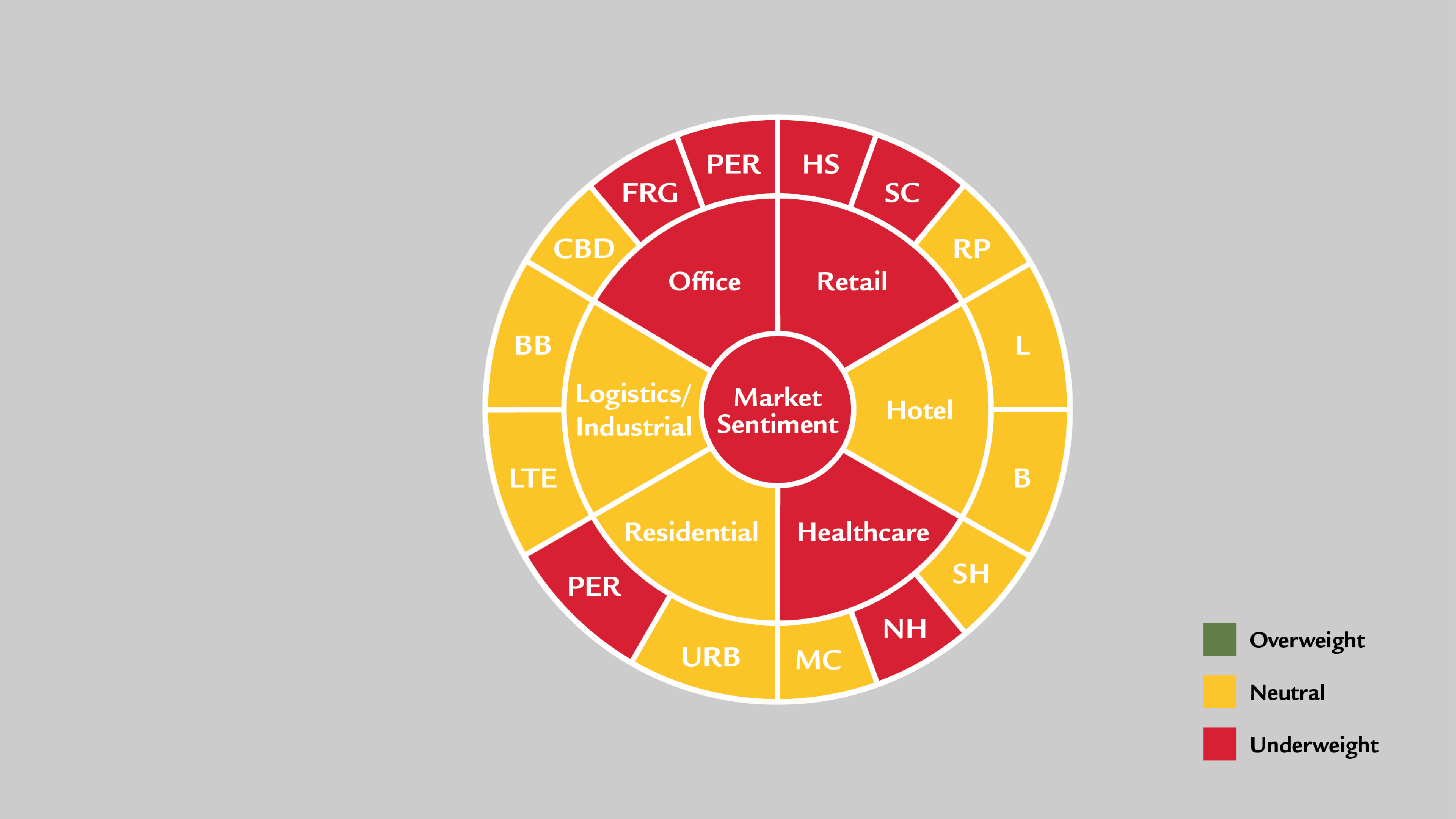

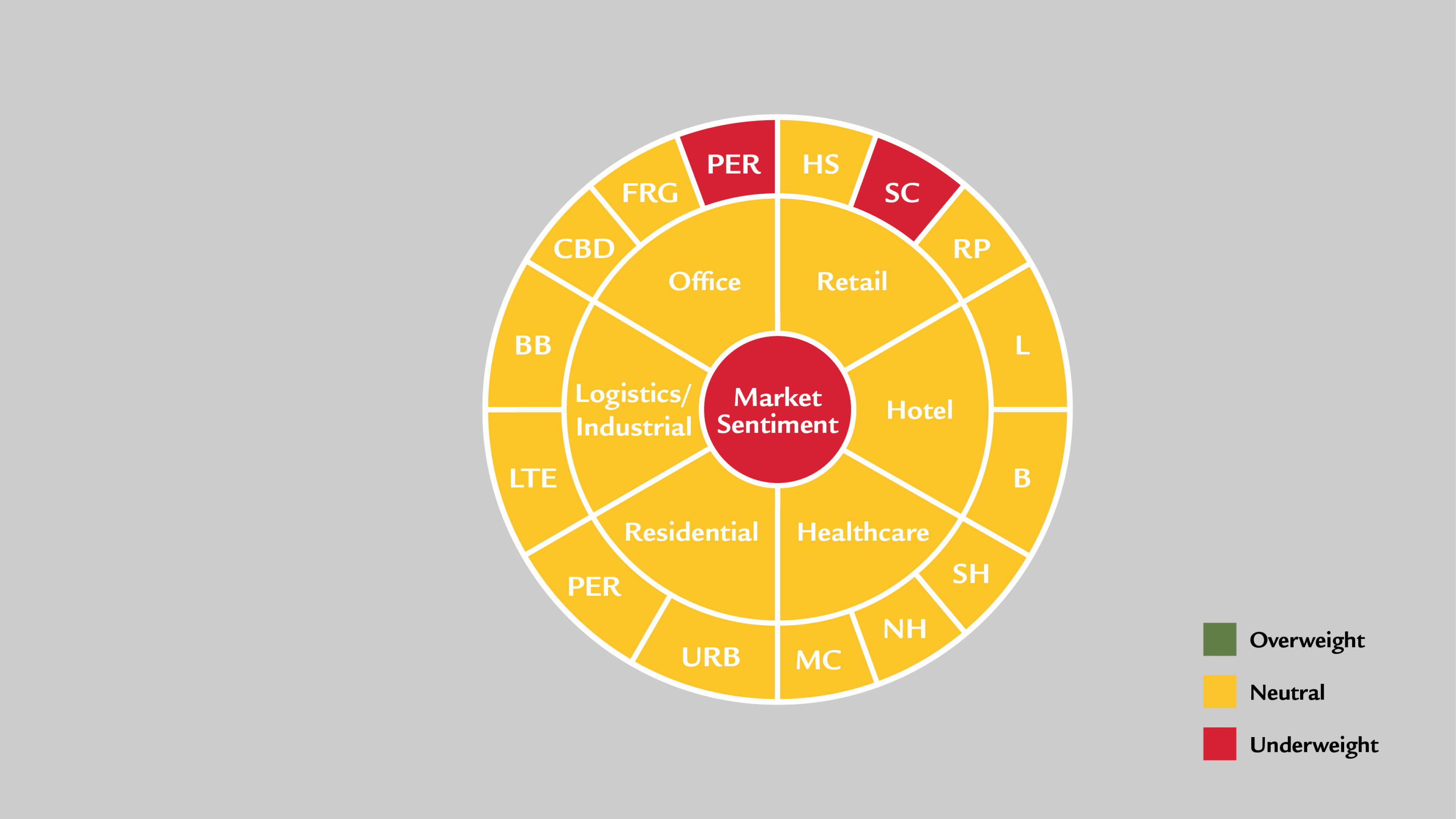

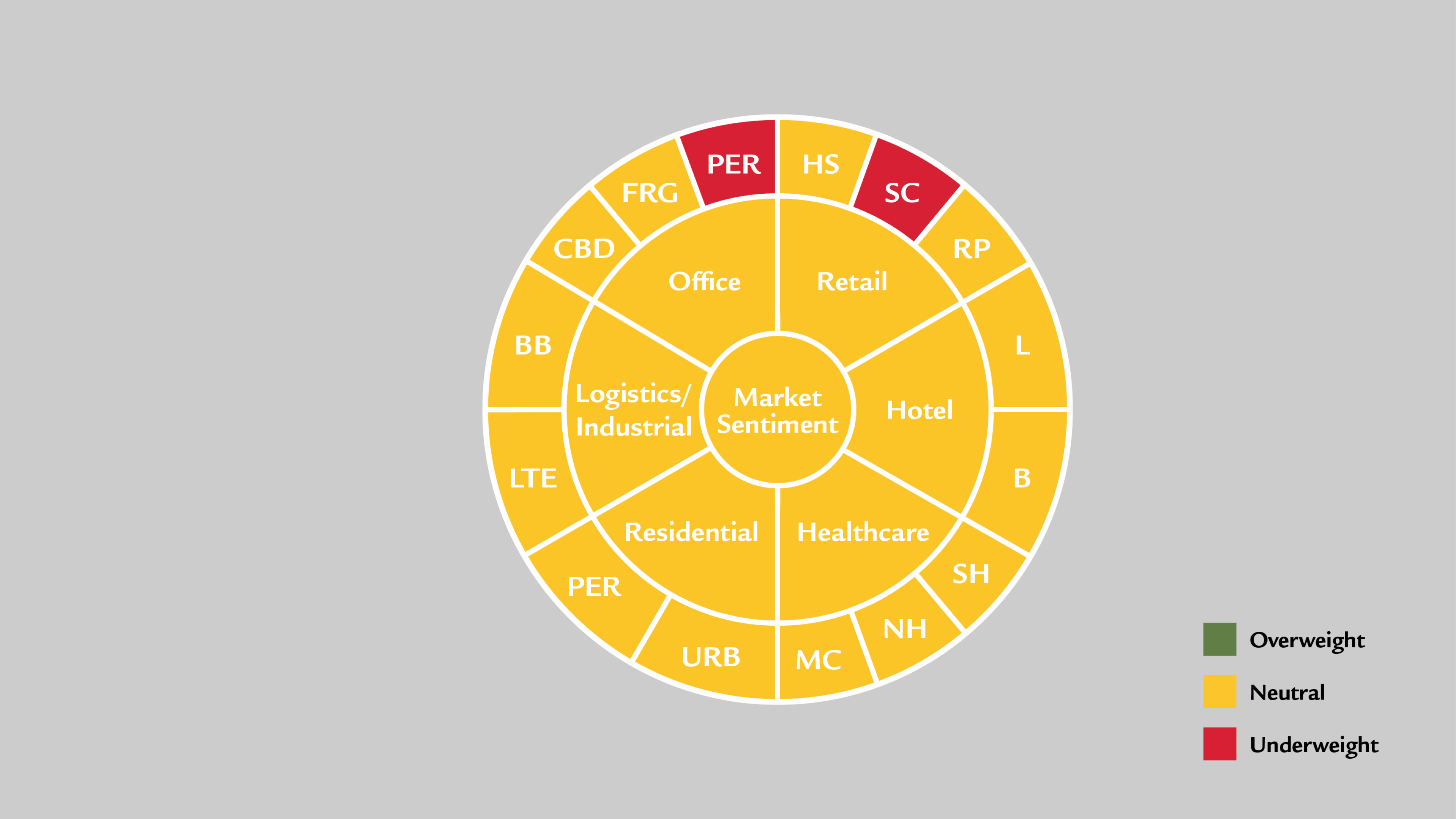

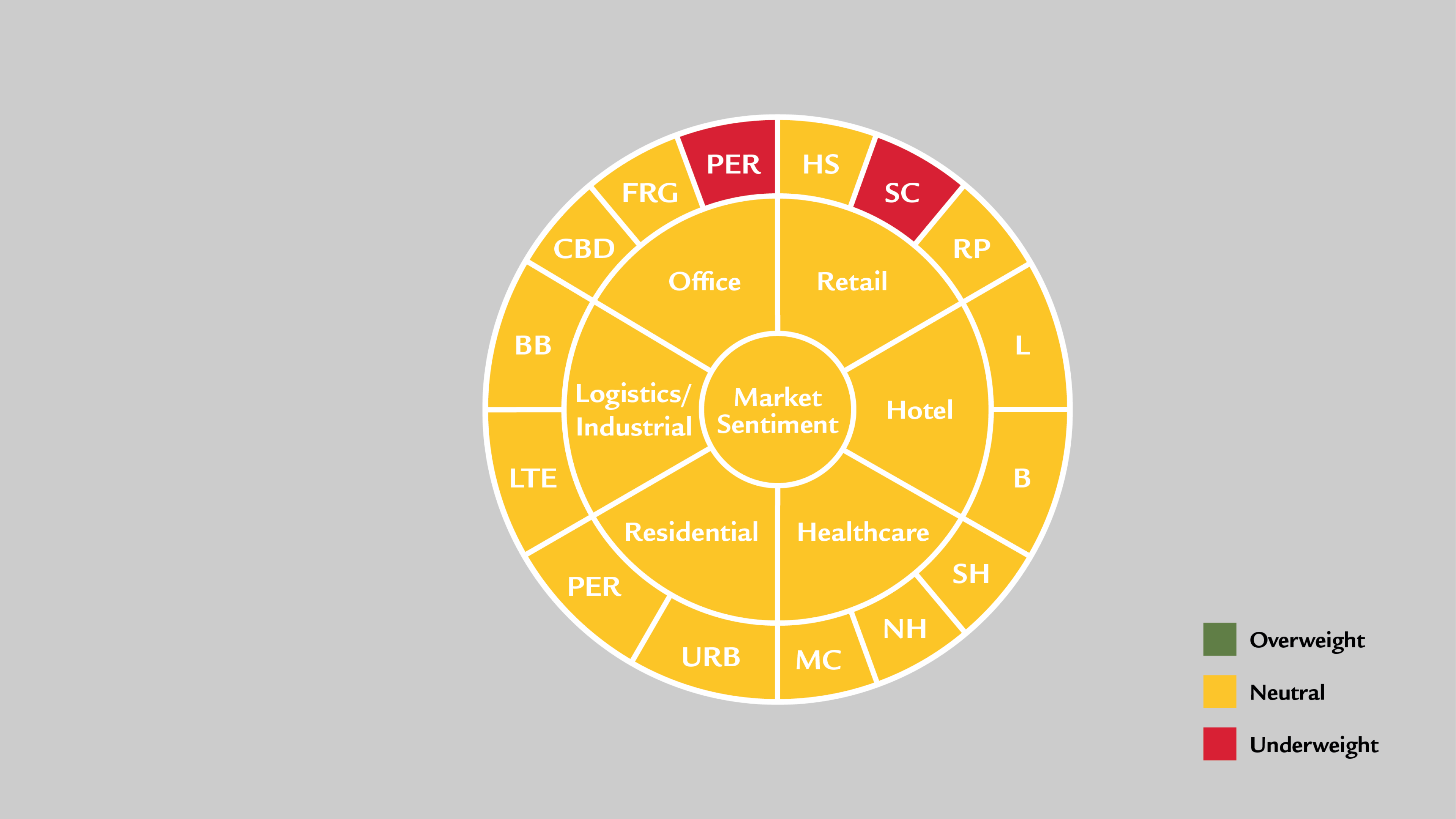

Overweight indicates that as of today we recomment investing in relatively higher share in a given category; the assessment factors in current and future socio-economic and real estate data. The assessment takes an absolute view and is not relative towards other categories/countries.

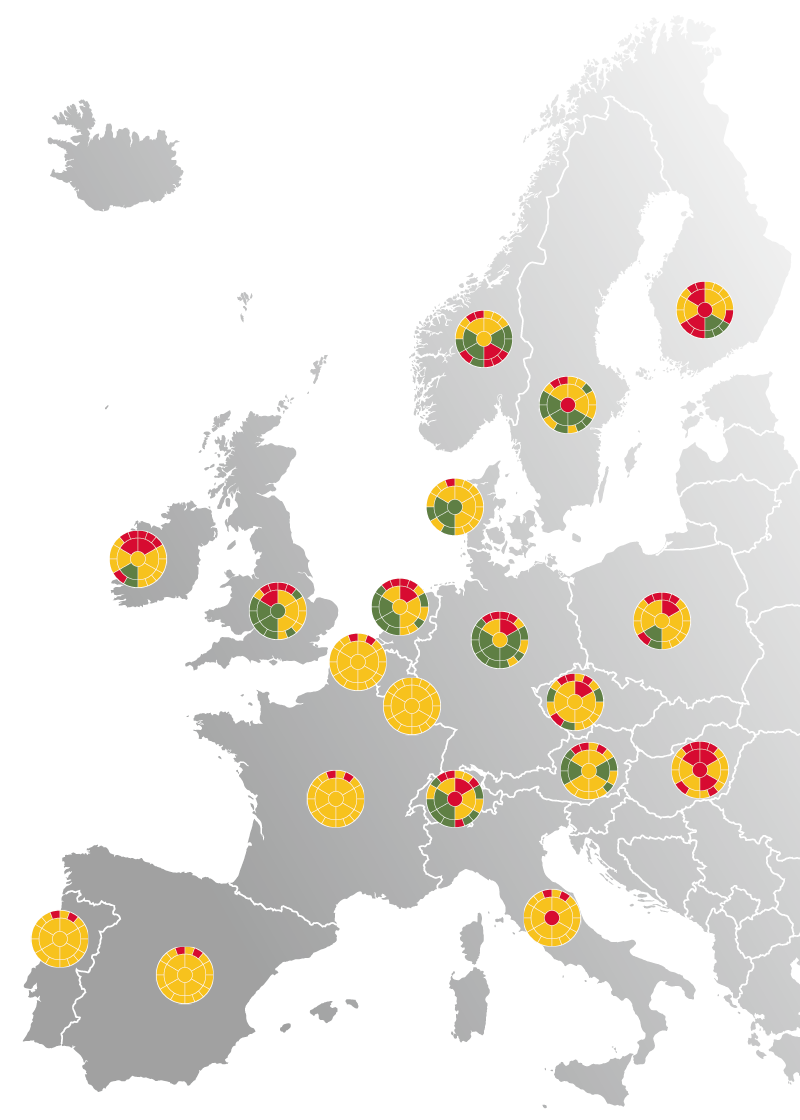

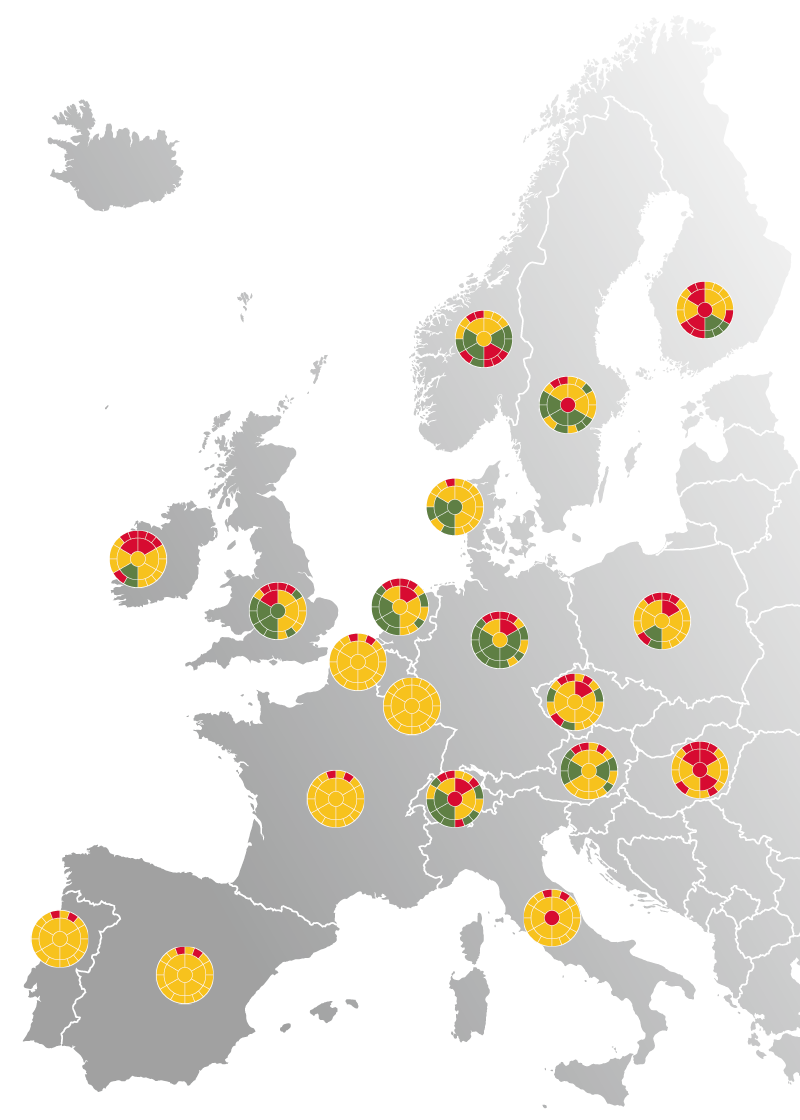

Market investment – Europe

(Scroll down for further details on the individual countries)

Market investment - Europe

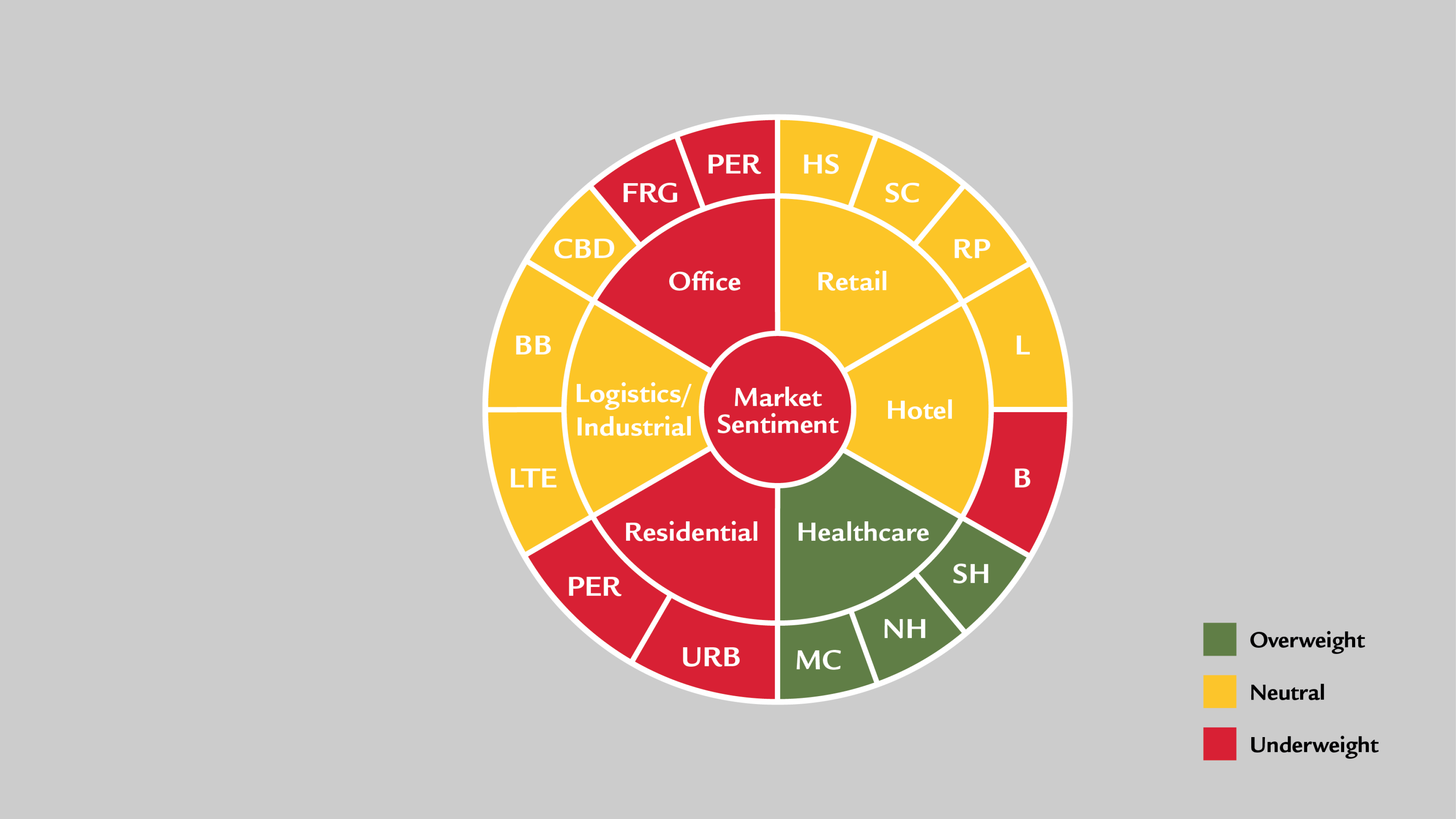

United Kingdom

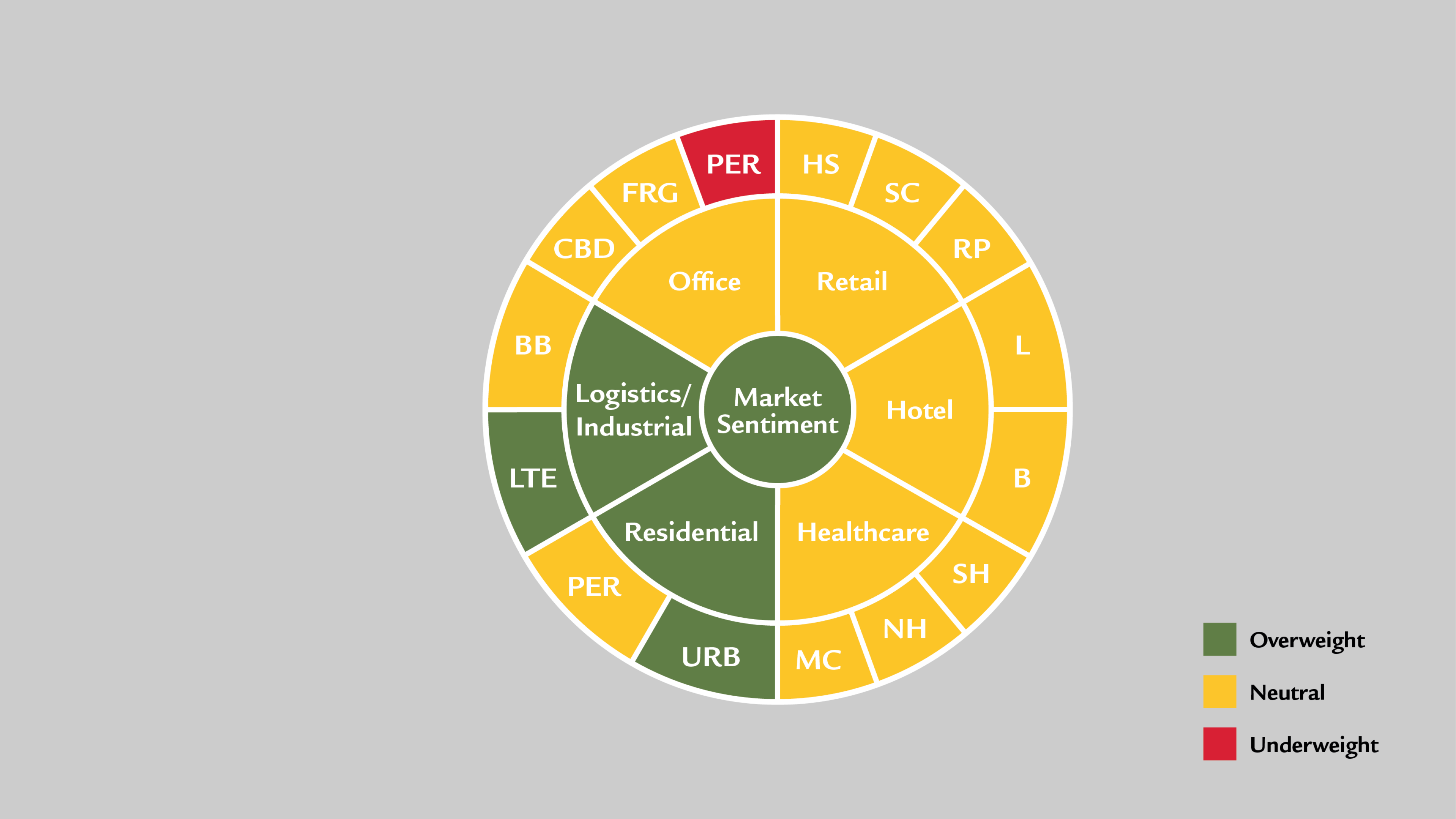

France

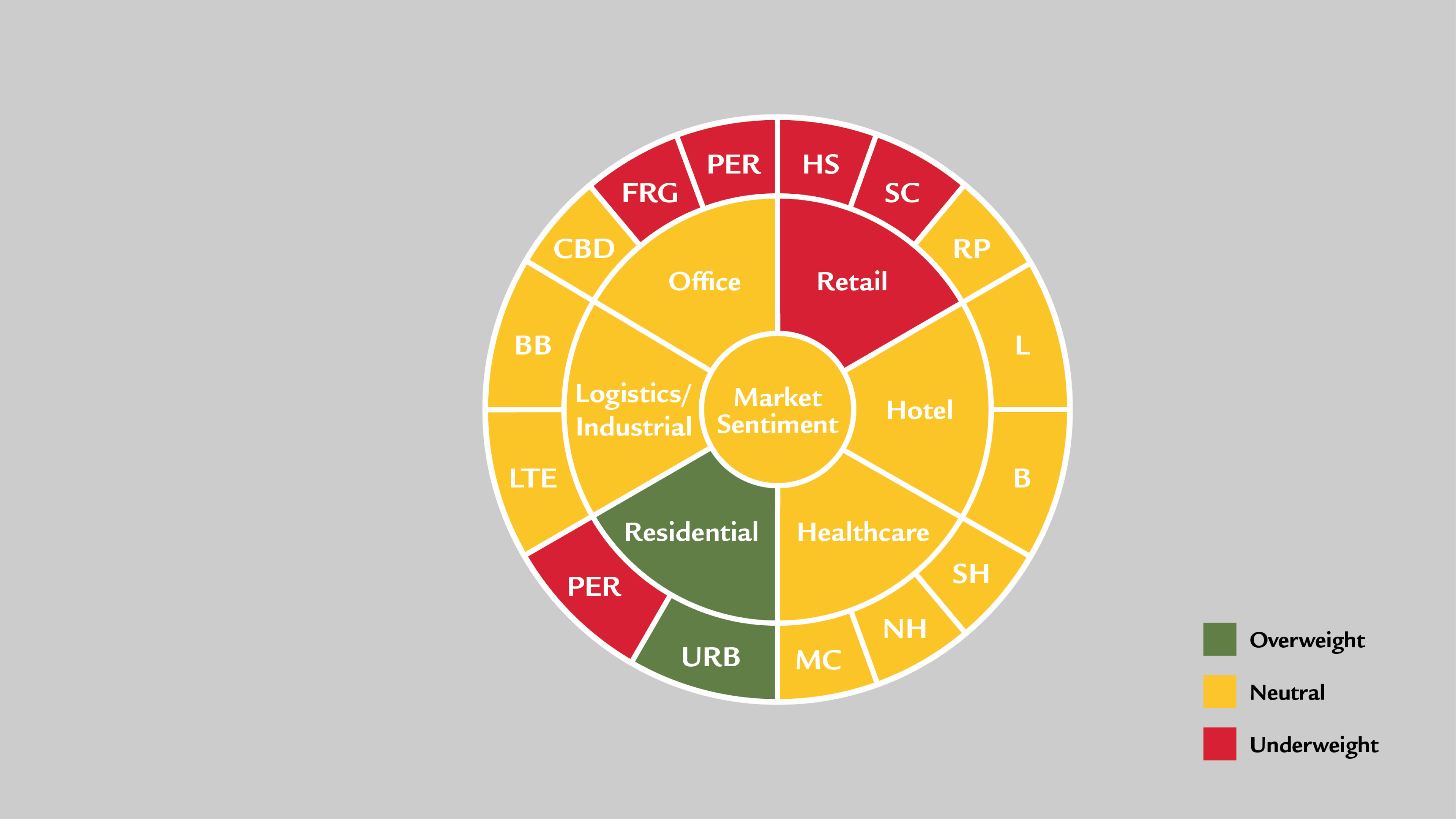

Germany

Switzerland

Benelux, Austria, Ireland

Belgium

Netherlands

Luxembourg

Austria

Ireland

Sweden, Norway, Finland, Denmark

Sweden

Norway

Finland

Denmark

Poland, Czech Republic, Hungary

Poland

Czech Republic

Hungary

Italy, Spain, Portugal

Italy

Spain

Portugal