USA: weak consumption, falling inflation and contradictory labour market figures. Europe: greater focus on consolidation of national budgets. China: trade barriers and localisation of manufacturing suggest a higher inflation environment.

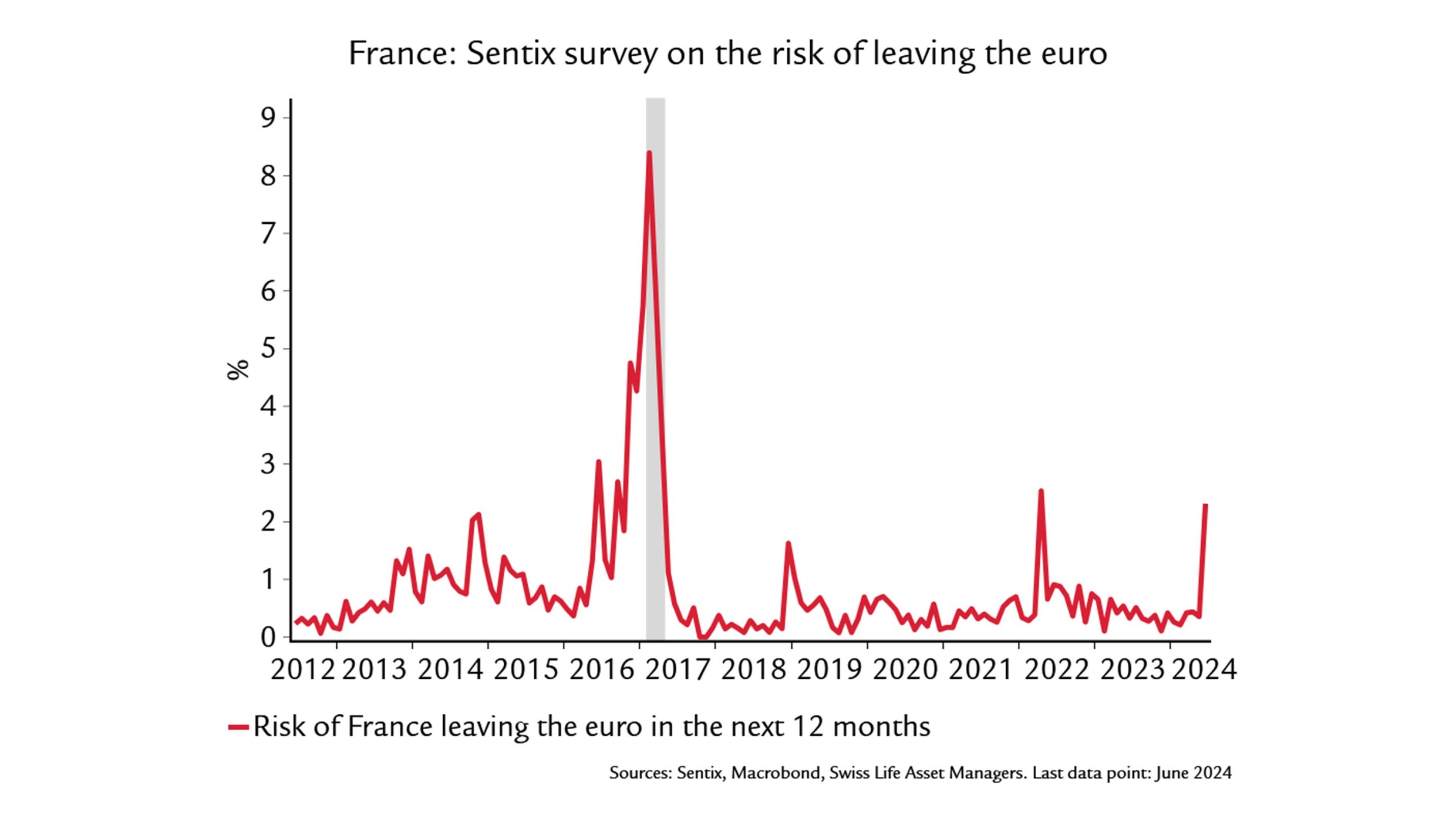

Chart of the month

Financial markets are unsettled following President Macron’s dissolution of the French parliament. He is unlikely to maintain his current majority. As regards the form that any future majority government may take, it should be noted that even the Rassemblement national party no longer wants to leave the euro. Unlike in the run-up to the 2017 presidential elections, there seem to be no extreme concerns over the break-up of the monetary union. On the other hand, it is unlikely that we will see any fiscal consolidation at any point in the near future. The increased risk premium on French government bonds should remain in place for now.