Attacks on ships in the Red Sea lead to higher transport costs, but with limited inflation risks. Survey data suggests that the US had a better start to 2024 than Europe. China: Real estate crisis and gloomy sentiment are causing weak growth and deflation.

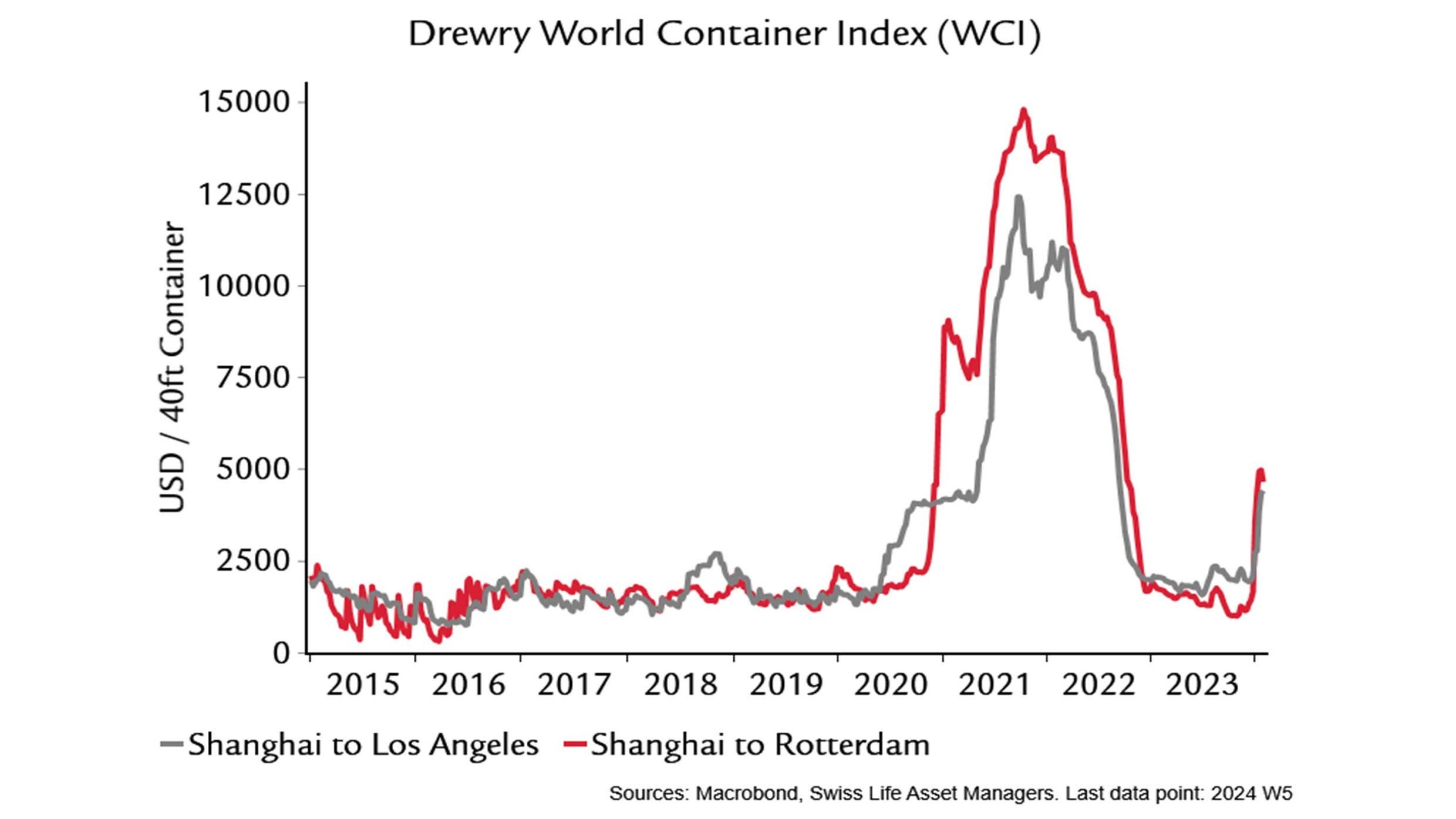

Chart of the month

The rapid increases in transport prices since December as a result of the attacks on ships in the Red Sea are bringing back memories of the pandemic and thus inflation fears. However, several factors do not support a similarly strong rise in goods prices. On the supply side, there is currently no global shortage of goods or container ships. The lengthening of delivery times is less pronounced and more predictable. At the same time, demand for goods is tending to decline, whereas it exploded during the pandemic. This is likely to reduce companies’ price-setting power. We are now keeping a particularly close eye on the development of import and producer prices.